Global Insurance Broking Market – Industry Trends and Forecast to 2030

Report ID: MS-237 | Business finance | Last updated: Dec, 2024 | Formats*:

Insurance Broking Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

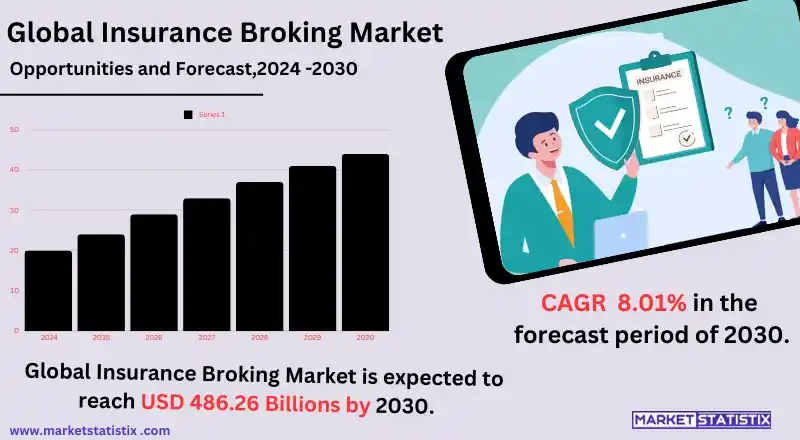

| Growth Rate | CAGR of 8.01% |

| Forecast Value (2030) | USD 486.26 Billion |

| By Product Type | General Insurance, Life Insurance, Health Insurance, Others |

| Key Market Players |

|

| By Region |

Insurance Broking Market Trends

Developing demand for risk management solutions within and across industries has exclusively encouraged the growth of the insurance broking market. Businesses face such multifaceted risks nowadays: cyber threats, climate change, and evolving regulations all require coverage with individualised speciality insurance products as well as access to specialist advisory services. Insurance brokers are really those important intermediaries in working through those complexities for clients, providing tailored insurance options as well as risk assessment and claims management. In addition, the transformation of the insurance sector via digitalisation has been a boon to the insurance broking market. Cutthroat technologies such as artificial intelligence, data analytics, and particularly digital platforms allow brokers to deliver more tailor-made customer experiences, increase operational efficiencies, and broaden their reach. Rising awareness regarding the benefits of insurance across emerging markets and regulatory changes mandating insurance for certain sectors also offer a boost to the growth of this market across the world.Insurance Broking Market Leading Players

The key players profiled in the report are HDFC, Life Insurance Corporation, ICICI Lombard General, Insurance, Life Insurance Corporation of India., Marsh & McLennan Companies, Inc., Aon plc, Willis Towers Watson, Arthur J. Gallagher & Co., Brown & Brown, Inc., Lockton Companies, Alliant Insurance Services, HUB International Limited, Edgewood Partners Insurance Center (EPIC), USI Insurance Services, Aditya Birla Capital Ltd., Edgewood Partners Insurance Center, HUB International Limited, USI Insurance ServicesGrowth Accelerators

Developing demand for risk management solutions within and across industries has exclusively encouraged the growth of the insurance broking market. Businesses face such multifaceted risks nowadays: cyber threats, climate change, and evolving regulations all require coverage with individualised speciality insurance products as well as access to specialist advisory services. Insurance brokers are really those important intermediaries in working through those complexities for clients, providing tailored insurance options as well as risk assessment and claims management. In addition, the transformation of the insurance sector via digitalisation has been a boon to the insurance broking market. Cutthroat technologies such as artificial intelligence, data analytics, and particularly digital platforms allow brokers to deliver more tailor-made customer experiences, increase operational efficiencies, and broaden their reach. Rising awareness regarding the benefits of insurance across emerging markets and regulatory changes mandating insurance for certain sectors also offer a boost to the growth of this market across the world.Insurance Broking Market Segmentation analysis

The North America Insurance Broking is segmented by Type, and Region. By Type, the market is divided into Distributed General Insurance, Life Insurance, Health Insurance, Others . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Furthermore, the market competition in the insurance broking industry is characterised by a tough battle among worldwide players, regional firms, and developing digital platforms. The market is dominated by big players, like Marsh, Aon, and Towers Watson, and uses the network, well-established relationships with clients, and product diversity on their insurance solutions. Their conception is always modernising through high-level analytics, tools for managing risks, and custom insurance products, which can complement specific industries. Regional brokers differ completely in their localised knowledge and personalised service with competitive pricing, which attracts SMEs."Challenges In Insurance Broking Market

Various challenges pose a risk to either growth or efficiency in the insurance broking market, with the most important being increasing regulatory scrutiny and compliance requirements. Brokers must be compliant with evolving local and international regulations that differ significantly across jurisdictions. This adds complexity and operating costs, particularly for small brokers who do not have a full set of resources. Moreover, trade commission structures may become cheaper in that they have to comply with stringent stipulations of rules on transparency and possibly bring about a need for lifestyle adjustments in compliance with the financial viability-reporting requirement on the part of brokers. Next up is the speed of technological advancement and the much talked about "digital transformation." Technology, undoubtedly a pathway to efficiency and innovation, is regarded negatively by many traditional brokers as they grapple with meeting new client expectations regarding digitization. The additional pressure on brokers comes from an environment with changes in the very volatile economic conditions, affected by changes with respect to political unrest around the world, changing risk profiles such as losses related to cyber threats, and others, not to mention climate change, which lead to constant recommissioning and diversification of offerings to remain relevant in this dynamic market.Risks & Prospects in Insurance Broking Market

The insurance broker market is thriving because risk management and insurance awareness are increasing among many sectors. It makes great sense for the many complexities that businesses and individuals have to contend with to see an increase in demand for specially tailored insurance solutions, creating possible opportunities for brokers to serve the growing demand with increasingly specific policies and expert advice. There are also emerging and growing industries, such as renewable energy, telemedicine, and cybersecurity, creating more niches for brokers to serve with special coverage products addressing unique risks. These are also fly-by-night developments much needed among the middle-class income earners in relatively growing economies such as those in Asia and Africa that seek and buy ever-growing health, life, and property insurance. Adopt digital platforms, artificial intelligence, and data analytics to enable brokers to handle process improvements, enhanced risk assessments, and personalised recommendations. Insurtech innovations are also driving collaborations, enabling brokers to enter underserved markets with digital-first solutions. Additionally, there are changes in regulations across the geography with the motivations of enhancing transparency and competition that create comfortable environments in which insurance brokers can enjoy expanding their presence in the market to meet increasingly changing customer expectations.Key Target Audience

Within the insurance broking market, the most significant target audience includes businesses and individual clients who approach the insurance broker for specialised and personalised insurance solutions. From the businesses' point of view, small and medium enterprises (SMEs), large corporations, and start-up firms across different fields—from manufacturing to health services, IT, retail, and construction—are necessary audience representatives who engage an insurance broker for possible risk coverage such as property damage, liability, employee benefits, and cybersecurity. They come to brokers who can offer them policies tailor-made to suit industry-specific risks while ensuring that the company remains compliant with set laws and regulations and protects the company's assets and operations.,, Even at the individual level, the target audience would comprise high-net-worth individuals, families, and professionals looking for all-round personal insurance coverage, including health, life, vehicle, and home insurances, requiring advisory services quite personally. Such unique asset owners, like those with fine art or luxury properties, are also potential clients to a broker via specialised insurance.Merger and acquisition

The broking in which activities has been really talking about changes within the landscape of the insurance market in terms of a lot of significant mergers and acquisitions. For instance, Lockton has acquired approval from the Insurance Regulatory and Development Authority of India (IRDAI) to merge with Arihant Insurance Broking Services, thereby enhancing its strength in the Indian market in view of the increasingly emerging demand for risk management services. In fact, Stone Point Capital bought a $1.95 billion stake in Truist Insurance Holdings, and Brookfield bought Argo Group International Holdings at $1.1 billion, which are all phenomenal investments—showing the strong investment interest toward these types of firms so that they can realise synergies and expand service offerings through acquisitions. Strategically, the sector is acquiring companies for more than just market share enlargement; they are also acquiring the capability to meet customer needs across the board. For instance, Travellers announced its purchase of Corvus Insurance for around $435 million in an effort to bolster cyber underwriting. Aside from that, NFP is fully operational with its acquisition of Advanced Insurance Consultants to further enrich its commercial insurance offerings in vital markets. The new wave of mergers & acquisitions will be very competitive as they will fish into the pond that will differentiate firms based on how well they build strategic partnerships or acquire other firms in order to meet customer needs and market changes effectively. >Analyst Comment

"The global insurance broking market is experiencing significant growth, driven by factors such as increasing awareness of insurance products, rising disposable incomes, and the growing complexity of insurance policies. Brokers play a crucial role in helping individuals and businesses navigate the insurance landscape, providing expert advice and negotiating favourable terms."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Insurance Broking- Snapshot

- 2.2 Insurance Broking- Segment Snapshot

- 2.3 Insurance Broking- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Insurance Broking Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 General Insurance

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Life Insurance

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Health Insurance

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Insurance Broking Market by Mode

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Online

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Offline

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Insurance Broking Market by End-User

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Individuals

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Corporate

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 HDFC

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Life Insurance Corporation

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 ICICI Lombard General

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Insurance

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Life Insurance Corporation of India.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Marsh & McLennan Companies

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Inc.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Aon plc

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Willis Towers Watson

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Arthur J. Gallagher & Co.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Brown & Brown

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Inc.

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Lockton Companies

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Alliant Insurance Services

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 HUB International Limited

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Edgewood Partners Insurance Center (EPIC)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 USI Insurance Services

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Aditya Birla Capital Ltd.

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Edgewood Partners Insurance Center

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 HUB International Limited

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

- 8.21 USI Insurance Services

- 8.21.1 Company Overview

- 8.21.2 Key Executives

- 8.21.3 Company snapshot

- 8.21.4 Active Business Divisions

- 8.21.5 Product portfolio

- 8.21.6 Business performance

- 8.21.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Mode |

|

By End-User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Insurance Broking in 2030?

+

-

How big is the North America Insurance Broking market?

+

-

How do regulatory policies impact the Insurance Broking Market?

+

-

What major players in Insurance Broking Market?

+

-

What applications are categorized in the Insurance Broking market study?

+

-

Which product types are examined in the Insurance Broking Market Study?

+

-

Which regions are expected to show the fastest growth in the Insurance Broking market?

+

-

What are the major growth drivers in the Insurance Broking market?

+

-

Is the study period of the Insurance Broking flexible or fixed?

+

-

How do economic factors influence the Insurance Broking market?

+

-