North America Insurance Telematics Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1001 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The insurance telematics market covers technologies that combine telecommunications and data analytics in monitoring aspects of driving behaviour and vehicle usage. Data are collected live on variables like acceleration speed, braking, and mileage through GPS-enabled devices or mobile applications to develop risk profiles with more precision and render charges for personalised usage-based insurance (UBI) policies. This motivates the insured to implement safer driving habits while enabling the insurer to price the product better and keep down fraudulent claim occurrences. In better times, as the consumer evolves to become more conscious of transparent and fair insurance and as data analytic capabilities hit further advancements, there is a steady prospective growth window for the insurance telematics market.

Insurance Telematics Report Highlights

| Report Metrics | Details |

|---|---|

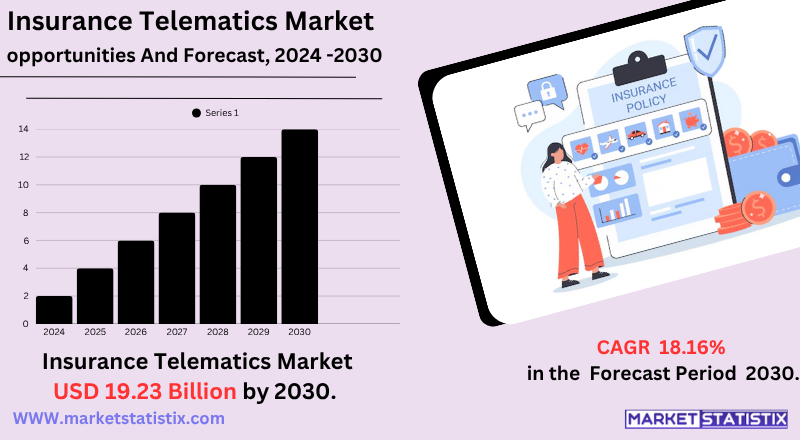

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 18.16% |

| Forecast Value (2030) | USD 19.23 Billion |

| By Product Type | Pay-How-You-Drive (PHYD), Pay-As-You-Drive (PAYD), Manage-How-You-Drive (MHYD) |

| Key Market Players |

|

| By Region |

|

Insurance Telematics Market Trends

A major tendency is Usage-Based Insurance (UBI), especially the "Pay-How-You-Drive" (PHYD) model, which is widely adopted, where the premium is directly connected to individual driving behaviour collected through telematics devices. This change is operated for the consumer's desire for more accurate risk evaluation and an individual, potentially low premium, than the demand of both insurers. Increased integration of telematics with the connected car ecosystem is also important, allowing insurers to access the vehicle data directly from the onboard system. Increasing emphasis on road safety and environmental concerns is another driver, as telematics promote safe driving practices and can help reduce emissions.

Insurance Telematics Market Leading Players

The key players profiled in the report are TrueMotion (United States), Liberty Mutual (United States), Nationwide (United States)Octo Telematics (Italy), State Farm (United States), IMS (Insurance & Mobility Solutions) (Canada), Allstate (United States), Lemonade (United States), Progressive (United States), The Floow (United Kingdom), Cambridge Mobile Telematics (United States), Root Insurance (United States), Zubie (United States)Growth Accelerators

The insurance telematics market covers technologies that combine telecommunications and data analytics in monitoring aspects of driving behaviour and vehicle usage. Data are collected live on variables like acceleration speed, braking, and mileage through GPS-enabled devices or mobile applications to develop risk profiles with more precision and render charges for personalised usage-based insurance (UBI) policies. This motivates the insured to implement safer driving habits while enabling the insurer to price the product better and keep down fraudulent claim occurrences. In better times, as the consumer evolves to become more conscious of transparent and fair insurance and as data analytic capabilities hit further advancements, there is a steady prospective growth window for the insurance telematics market.

Insurance Telematics Market Segmentation analysis

The North America Insurance Telematics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Pay-How-You-Drive (PHYD), Pay-As-You-Drive (PAYD), Manage-How-You-Drive (MHYD) . The Application segment categorizes the market based on its usage such as Driver Behavior Analysis, Vehicle Tracking, Risk Assessment. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

- Targa Telematics acquires Drive-it (January 2024): Targa Telematics bought Drive-it, an Israeli spin-off of Earnix specialising in AI-driven driver behaviour analysis. This procurement led to the launch of Targa Drive, a use-based insurance (UBI) telematics solution that utilises machine learning and smartphone-based data collection to refine risk assessment models.

- PowerFleet Merges with MiX Telematics and Acquires Movingdots: PowerFleet's strategic fusion with mixed telematics and acquisition of Movingdots aimed to strengthen its telematics sacrifice. These features are expected to improve the power of Powerfleet in connected vehicle technology.

- Saga PLC Partners with Ageas in $186 Million Deal (December 2024): Saga PLC agreed to sell the insurance business, Acromas Insurance, to Belgian insurance company Ageas for £ 67.5 million. The agreement also established a 20-year partnership in which Abeas's UK subsidiaries will run Saga's motor and housing insurance products, with a view to utilising telematics data for personalised insurance offers.

Challenges In Insurance Telematics Market

- Data privacy concerns: Consumers are cautious of sharing individual driving data, afraid of misuse or unauthorised access, which disrupts adopting telematics-based insurance solutions.

- High implementation costs: infrastructure can be prohibited for the initial investment and support required for telematics equipment, especially for small insurance firms, limiting market expansion.

- Issues of data accuracy and reliability: The wrong data collection can cause incorrect assessment of driving behaviour due to device malfunction or signal issues, reducing confidence in telematics programmes.

Risks & Prospects in Insurance Telematics Market

A significant growth area lies in the continuous expansion of Usage-Based Insurance (UBI), where policyholders benefit from prizes directly linked to their real steering behaviour, promoting safer habits and fairer prices. This is even more fuelled by the deepening of telematics integration with connected car ecosystems, allowing direct access for insurers to access to rich and real-time data from integral systems for highly accurate risk assessments and simplified claims. The market also benefits from the expansion of telematics in commercial vehicle fleets, where it helps optimise operations, reduce fuel costs and improve driver safety.

Key Target Audience

- ,

- Automotive Manufacturers & Dealerships: Embed insurance at point of sale for added convenience. ,

Merger and acquisition

- Targa Telematics acquires Drive-it (January 2024): Targa Telematics bought Drive-it, an Israeli spin-off of Earnix specialising in AI-driven driver behaviour analysis. This procurement led to the launch of Targa Drive, a use-based insurance (UBI) telematics solution that utilises machine learning and smartphone-based data collection to refine risk assessment models.

- PowerFleet Merges with MiX Telematics and Acquires Movingdots: PowerFleet's strategic fusion with mixed telematics and acquisition of Movingdots aimed to strengthen its telematics sacrifice. These features are expected to improve the power of Powerfleet in connected vehicle technology.

- Saga PLC Partners with Ageas in $186 Million Deal (December 2024): Saga PLC agreed to sell the insurance business, Acromas Insurance, to Belgian insurance company Ageas for £ 67.5 million. The agreement also established a 20-year partnership in which Abeas's UK subsidiaries will run Saga's motor and housing insurance products, with a view to utilising telematics data for personalised insurance offers.

Analyst Comment

The insurance telematics market is experiencing significant growth, with a projected size of approximately $5.89 billion in 2025. It is expected to expand with a robust compound growth rate (CAGR), reaching up to $19.23 billion in 2032. The market is even more driven by advances in connected automotive technologies and AI/ML integration for more risk assessment. Precise fraud detection and processing of simplified claims, reflecting a growing demand from consumers and insurers for more insurance and equitable solutions.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Insurance Telematics- Snapshot

- 2.2 Insurance Telematics- Segment Snapshot

- 2.3 Insurance Telematics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Insurance Telematics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Pay-As-You-Drive (PAYD)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Pay-How-You-Drive (PHYD)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Manage-How-You-Drive (MHYD)

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Insurance Telematics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Driver Behavior Analysis

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Vehicle Tracking

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Risk Assessment

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Insurance Telematics Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Allstate (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Cambridge Mobile Telematics (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 IMS (Insurance & Mobility Solutions) (Canada)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Lemonade (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Liberty Mutual (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Nationwide (United States)Octo Telematics (Italy)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Progressive (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Root Insurance (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 State Farm (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 The Floow (United Kingdom)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 TrueMotion (United States)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Zubie (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Insurance Telematics in 2030?

+

-

How big is the North America Insurance Telematics market?

+

-

How do regulatory policies impact the Insurance Telematics Market?

+

-

What major players in Insurance Telematics Market?

+

-

What applications are categorized in the Insurance Telematics market study?

+

-

Which product types are examined in the Insurance Telematics Market Study?

+

-

Which regions are expected to show the fastest growth in the Insurance Telematics market?

+

-

Which application holds the second-highest market share in the Insurance Telematics market?

+

-

What are the major growth drivers in the Insurance Telematics market?

+

-

The insurance telematics market covers technologies that combine telecommunications and data analytics in monitoring aspects of driving behaviour and vehicle usage. Data are collected live on variables like acceleration speed, braking, and mileage through GPS-enabled devices or mobile applications to develop risk profiles with more precision and render charges for personalised usage-based insurance (UBI) policies. This motivates the insured to implement safer driving habits while enabling the insurer to price the product better and keep down fraudulent claim occurrences. In better times, as the consumer evolves to become more conscious of transparent and fair insurance and as data analytic capabilities hit further advancements, there is a steady prospective growth window for the insurance telematics market.

Is the study period of the Insurance Telematics flexible or fixed?

+

-