IoT in Construction Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-409 | Consumer Goods | Last updated: Feb, 2025 | Formats*:

IoT in Construction Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

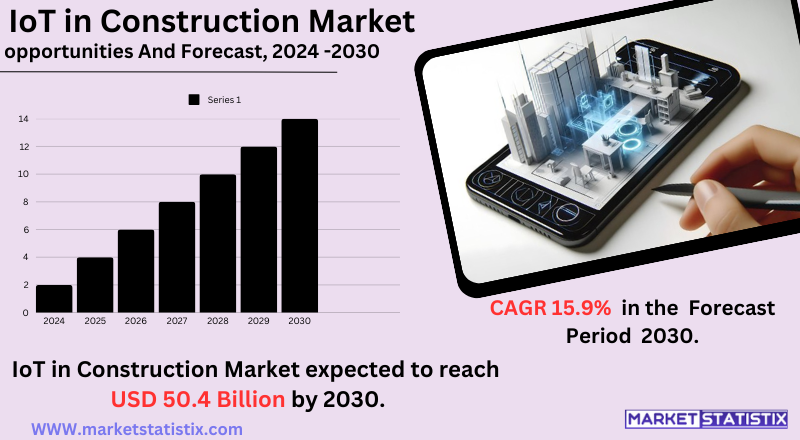

| Growth Rate | CAGR of 15.9% |

| Forecast Value (2030) | USD 50.4 Billion |

| By Product Type | Hardware, Software, Connectivity |

| Key Market Players |

|

| By Region |

IoT in Construction Market Trends

The IoT in the construction market has a good chance of benefiting the entire industry due to the growing demand for effectiveness, increased safety, and environmental consideration in the construction projects. With the help of the IoT devices, resource utilisation and safety monitoring can be improved through real-time monitoring of data analytics, optimising cost reduction, risk mitigation, and enhancement of project outcomes. From a regional acceptability perspective, North America still dominates the IoT in the construction market because the technological innovations adopted as per the investments made in smart infrastructure projects made them leaders in application solutions. On the contrary, Asia and the Pacific are likely to dominate the growth frontier in the coming years. This could possibly be attributed to the rate of urbanisation/developmental activities being carried out in most countries, government policies favouring such projects as smart city initiatives, and specific projects from countries like China and India. Europe would also be another key market since there has been a lot of emphasis on sustainable construction practices and severe safety regulations, which drive the growth of adoption in IoT solutions.IoT in Construction Market Leading Players

The key players profiled in the report are AOMS Technologies, Triax Technologies, Autodesk Inc., Oracle Corporation, Hilti Corporation, Topcon Corporation, Trimble Inc., Pillar Technologies, Inc., Hexagon Metrology ABGrowth Accelerators

The IoT is turning a corner in construction as the entire industry is rapidly adapting to increased demand for efficiency, safety, and cost optimisation in construction projects. One of the major trends in this space is the increased application of Building Information Modelling (BIM), upstream integrated with IoT sensors, which enables live monitoring of construction activity, clash detection, and proactive problem solving that ends up leading to smooth completion of projects with less rework. Another key trend that is happening nowadays is an ever-increasing market for predictive maintenance solutions, where machinery health and performance can be monitored with IoT sensors that automatically warn of impending breakdowns so that maintenance can be scheduled in advance of downtime to avoid interruption in production and prolong the life of equipment. This allows one to keep the production process running smoothly while at the same time improving safety by avoiding unexpected equipment failure.IoT in Construction Market Segmentation analysis

The Global IoT in Construction is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Hardware, Software, Connectivity . The Application segment categorizes the market based on its usage such as Predictive Maintenance, Site Monitoring,, Safety Management, Fleet Management, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the IoT in construction market is driven by major technology providers, construction firms, and startups offering innovative solutions. Key players such as Trimble, Caterpillar, Bosch, and Autodesk dominate the market with smart sensors, predictive maintenance tools, and real-time monitoring systems. These companies focus on strategic partnerships, mergers, and acquisitions to expand their market presence and enhance IoT integration in construction projects. Additionally, cloud-based platforms and AI-driven analytics are becoming crucial differentiators, enabling firms to optimize productivity, safety, and cost efficiency.Challenges In IoT in Construction Market

The market for IoT in construction has to deal with costs that are high in deployment and complexity in integrating IoT solutions into the already existing construction processes. The initial investment required for IoT-enabled sensors, software, and connectivity infrastructure is a hindrance that small and mid-sized firms faced by many companies have to deal with. Slow adoption from technological changes mostly existing in the industry has also been considered as another factor to slow adoption since stakeholders usually prefer familiar methods to new digital solutions. Data security and privacy issues related to IoT devices are another significant challenge due to the immense amounts of sensitive project information generated by such devices, for which there is a risk of exposure to cyber threats. Incompatibility between different devices and platforms arises from the lack of standardized interoperability protocols for IoT. Inefficiencies would thus arise. Further, at remote construction sites, unreliable internet connections hamper real-time collection and analysis of data, preventing IoT applications in the industry from realising their full potential.Risks & Prospects in IoT in Construction Market

The market for IoT in construction has to deal with costs that are high in deployment and complexity in integrating IoT solutions into the already existing construction processes. The initial investment required for IoT-enabled sensors, software, and connectivity infrastructure is a hindrance that small and mid-sized firms faced by many companies have to deal with. Slow adoption from technological changes mostly existing in the industry has also been considered as another factor to slow adoption since stakeholders usually prefer familiar methods to new digital solutions. Data security and privacy issues related to IoT devices are another significant challenge due to the immense amounts of sensitive project information generated by such devices, for which there is a risk of exposure to cyber threats. Incompatibility between different devices and platforms arises from the lack of standardized interoperability protocols for IoT. Inefficiencies would thus arise. Further, at remote construction sites, unreliable internet connections hamper real-time collection and analysis of data, preventing IoT applications in the industry from realising their full potential.Key Target Audience

Key stakeholders in the construction industry's IoT sector include construction companies, contractors, and site managers who want real-time information to improve efficiency, safety, and cost management. Large infrastructure developers and realty companies deploy IoT solutions for predictive maintenance, smart monitoring, and workflow automation. Government agencies and local bodies also represent an important segment using IoT for smart city projects, traffic management, and sustainable urban planning.,, The technology providers, including IoT hardware manufacturers, software developers, and cloud service providers, contribute significantly to the growth of the market. Engineering firms and consultants rely on IoT-driven analytics to enhance project planning and execution. Equipment manufacturers and rental companies also leverage IoT-enabled asset tracking and predictive maintenance for improved uptime and operational efficiency.Merger and acquisition

There is a remarkable increase in mergers and acquisitions in the IoT construction market in order to improve the technological capabilities and also enhance the market presence of the companies involved. Some of the recent high-value deals are Telit's acquisition of Thales' cellular IoT products, which will have substantial offerings in industrial IoT segments like payment systems, energy solutions, etc. Moreover, the concerned IoT segment is characterised by moderation in M&A because of the incessant demand for such productivity, safety, and compliance IoT solutions on construction sites. Examples: Semtech buys Sierra Wireless, said to leverage both strengths in cellular and LoRa technologies to build full-IOT solutions for varied applications ranging from construction. As the industry progresses in this direction, strategic moves such as these are expected to bring innovation and growth prospects in the IoT construction market, which will grow vastly in the number of years to come. >Analyst Comment

IoT in construction is quickly advancing, as adoption by the sector is mostly fuelled by smart means of improving efficiency, safety, and management of projects. Real-time monitoring sensors, GPS tracking, and automated equipment can reduce operational costs and improve the decision-making process by making it easier to provide valuable data insights. The growth of AI, cloud computing, and 5G connectivity in the construction space has further encouraged the demand for connected construction sites with the promise of integration of data throughout the delivery process that can be done remotely.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 IoT in Construction- Snapshot

- 2.2 IoT in Construction- Segment Snapshot

- 2.3 IoT in Construction- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: IoT in Construction Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hardware

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Software

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Connectivity

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: IoT in Construction Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Site Monitoring

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Safety Management

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Fleet Management

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Predictive Maintenance

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Others

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Trimble Inc.

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Pillar Technologies

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Inc.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Triax Technologies

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 AOMS Technologies

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Hilti Corporation

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Topcon Corporation

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Autodesk Inc.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Oracle Corporation

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Hexagon Metrology AB

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of IoT in Construction in 2030?

+

-

Which application type is expected to remain the largest segment in the Global IoT in Construction market?

+

-

How big is the Global IoT in Construction market?

+

-

How do regulatory policies impact the IoT in Construction Market?

+

-

What major players in IoT in Construction Market?

+

-

What applications are categorized in the IoT in Construction market study?

+

-

Which product types are examined in the IoT in Construction Market Study?

+

-

Which regions are expected to show the fastest growth in the IoT in Construction market?

+

-

Which application holds the second-highest market share in the IoT in Construction market?

+

-

What are the major growth drivers in the IoT in Construction market?

+

-