North America Legal Process Outsourcing Services Market – Industry Trends and Forecast to 2032

Report ID: MS-542 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Legal Process Outsourcing Services Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

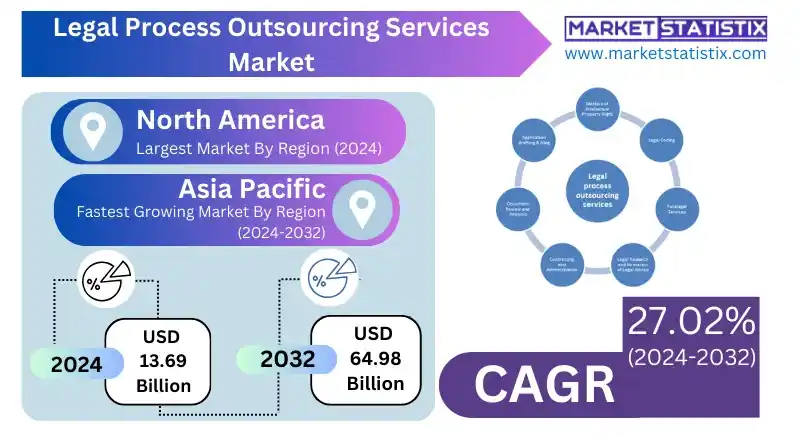

| Growth Rate | CAGR of 27.02% |

| Forecast Value (2032) | USD 64.98 Billion |

| By Product Type | Litigation Support, E-discovery, Review and Management, Compliance Assistance, Contract Drafting, Patent Support |

| Key Market Players |

|

| By Region |

|

Legal Process Outsourcing Services Market Trends

It's been proved that the LPO market has shifted gears towards technology-allied solutions. As such, as automation, AI, and ML evolve, LPO services have been changing their avatars. The changed avatars promise better speed, greater accuracy in document reviews, e-discovery, contract management, and thus lower costs as well as more efficiencies within services. There are additional specialised LPO services being introduced on top of these general types, for instance, those in IP, compliance, or regulatory affairs. In addition, LPOs are becoming interoperable in terms of regions. Different delivery centres for LPOs are springing up in many countries around the world to offer the services affordably and appropriately to the cultures that would use them. Flexible and scalable models make LPO even more attractive to clients as they enable firms to vary service levels according to varying load volumes and project requirements. Even in legal service delivery, there is definitely an approaching trend toward forming partnerships between law firms and LPO providers, thereby increasing the extent of cooperation in the provision of legal services. This allows law firms to concentrate on their core legal strategies while relying on the specialists and costs offered by LPOs.Legal Process Outsourcing Services Market Leading Players

The key players profiled in the report are Axiom Law, SunLexis, Elevate Services, Inc., Clarivate, UnitedLex, Litigation Services, Exigent, Cobra Legal Solutions, Integreon, Inc., Mindcrest, WNS (Holdings) Ltd., Lexplosion Solutions Private Limited, QuisLex, Vee Technologies, Infosys LimitedGrowth Accelerators

Cost-saving underpins the engine of current-day growth within the LPO services marketplace. Legal firms and corporate entities try to save costs related to wearing out manpower on labour-intensive jobs like document review or legal research by sending such work offshore to lower-cost regions. Also, complex and complicated laws increase the volume and scope of litigation, requiring detailed niche skills and scalable human resources that are most likely to be efficiently provided by LPO providers. Furthermore, technology, especially as AI and automation move into the picture, is turning out to be a lion's share driver for LPO because these technologies offer lower-cost LPO services with more speed and accuracy in the work performed.Legal Process Outsourcing Services Market Segmentation analysis

The North America Legal Process Outsourcing Services is segmented by Type, and Region. By Type, the market is divided into Distributed Litigation Support, E-discovery, Review and Management, Compliance Assistance, Contract Drafting, Patent Support . Geographically, the market is assessed across key Regions like United States (The West, Southwest, The Middle Atlantic, New England, The South, The Midwest) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Legal Process Outsourcing (LPO) services market is competitive, consisting of global outsourcing firms engaged in LPO, specialised legal service providers, and tech-driven companies. For instance, Integreon, UnitedLex, Elevate Services, and many more have made significant contributions to this industry by providing clients with less expensive legal research, contract management, and compliance solutions. The offshore countries like India, the Philippines, and South Africa attract increasing attention due to their skilled legal workforce and lower operational costs. Additionally, an increasing number of companies are making use of AI and automation to streamline processes, minimise errors, and speed up document-review processes, which further sharpens competition.Challenges In Legal Process Outsourcing Services Market

The LPO services market is full of challenges that could affect its growth. The most pressing of these barriers is the confidentiality and security of data since legal processes often involve protecting sensitive client information. Outsourcing offshores involves risks of data breach and compliance issues, especially when different data protection laws apply from one region to another. Adhering to international regulations, like GDPR or HIPAA, calls for a major investment in cybersecurity measures, which invariably increases the cost of operations for LPO providers. Also, the loss of control and supervision over the outsourced jobs induced the inconsistency in quality, making law firms and corporate legal departments cautious about adopting LPO services.Risks & Prospects in Legal Process Outsourcing Services Market

The LPO (Legal Process Outsourcing) services market holds considerable opportunities to grow, owing to the advances in technology and the continued evolution of business needs. Major opportunities include utilising artificial intelligence and robotic process automation in streamlining legal procedures to improve speed and efficiency while minimising errors. Demand for cybersecurity and data analytics outsourcing further provides ample scope for growth. This trend positions LPOs as innovators who can provide solutions to meet these evolving expectations from clients. North America stands out regionally as a very significant market for LPO services because of cost efficiency, technological innovations, and the increasingly complicated nature of legal operations. Money is spent on legal process outsourcing in the United States covering services such as e-discovery and document review. Asia-Pacific is creating opportunities as a major player thanks to its vast talent pool and value-for-money services. This growth momentum is driven by a higher rate of adoption of digital technologies and a greater need for specialised legal acumen.Key Target Audience

The bona fide target audiences for the LPO market are law firms, corporate legal departments, and state agencies seeking inexpensive solutions to legal support. Large law firms and multinational corporations outsource tasks like legal research, contract management, litigation support, and compliance to specialised LPO providers so that they can cut down on operational costs and maximise efficiency. Financial institutions and insurance companies also look towards LPO services for document reviews, regulatory compliance, and risk assessment, thereby meeting legally established standards and maximising resource utilisation.,, Startups, SMEs, and independent attorneys lacking in-house legal resources nevertheless require services of timely, high-quality legal support. Technology firms and consulting firms have also leveraged LPO services to efficiently run contract analysis and due diligence in light of the growing implementation of AI-driven legal analytics and automation. The growing demand for multilingual legal expertise and e-discovery services attracts yet another segment, namely global enterprises operating across different jurisdictions, enhancing the role of LPO providers in handling cross-border legal intricacies.Merger and acquisition

In recent years, most mergers and acquisitions have characterised the legal process outsourcing, or LPO, market, as it is a trend toward industry consolidation and expansion. In particular, Odyssey Investment Partners LLC, a private equity firm based in the United States, acquired Magna Legal Services in October 2022 for the purpose of growing and expanding the business. The acquisition indicates a strategic interest towards investing in established LPO providers to improve litigation support services. Other notable consolidations are that of UnitedLex acquiring QuisLex in July 2020 and that of Elevate Services acquiring Mindcrest in August 2020 with the same goal of expansion in service offerings and together building their strength in the market. These strategic movements emphasise that the industry is paying attention to all biotech and extensive capability extension to fit in the new legal department and law firm demands worldwide. >Analyst Comment

The LPO services market is constantly booming and expanding due to the high demand for cost-effectiveness and increased efficiency in the legal sector. It is characterized by other increasingly apparent drivers such as increasing complexity in legal processes, globalization of legal services, and modern technologies, including AI and automation. It segments by type of service such as document review, e-discovery, and legal research. Corporations and law firms are increasingly outsourcing non-core legal functions to focus on strategic initiatives. Emerging economies, especially those in Asia, serve for LPO majorly because of cheap solutions and clever legal professionals.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Legal Process Outsourcing Services- Snapshot

- 2.2 Legal Process Outsourcing Services- Segment Snapshot

- 2.3 Legal Process Outsourcing Services- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Legal Process Outsourcing Services Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Contract Drafting

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Review and Management

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Compliance Assistance

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 E-discovery

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Litigation Support

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Patent Support

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Legal Process Outsourcing Services Market by Component

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Software

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Service

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Legal Process Outsourcing Services Market by Organization Size

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Small and Medium-Sized Enterprises

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Large Enterprises

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Legal Process Outsourcing Services Market by Service Location

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 On-shore outsourcing

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Offshore outsourcing

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Legal Process Outsourcing Services Market by Industry

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 BFSI

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Government

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Automotive

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Healthcare & Life Sciences

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

9: Legal Process Outsourcing Services Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 The West

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.3 Southwest

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.4 The Middle Atlantic

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.5 New England

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.6 The South

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.7 The Midwest

- 9.7.1 Key trends and opportunities

- 9.7.2 Market size and forecast, by Type

- 9.7.3 Market size and forecast, by Application

- 9.7.4 Market size and forecast, by country

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 Cobra Legal Solutions

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 WNS (Holdings) Ltd.

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 SunLexis

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Clarivate

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 QuisLex

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 Elevate Services

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Inc.

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Axiom Law

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 UnitedLex

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 Exigent

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 Mindcrest

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 Litigation Services

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 Lexplosion Solutions Private Limited

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 Integreon

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

- 11.15 Inc.

- 11.15.1 Company Overview

- 11.15.2 Key Executives

- 11.15.3 Company snapshot

- 11.15.4 Active Business Divisions

- 11.15.5 Product portfolio

- 11.15.6 Business performance

- 11.15.7 Major Strategic Initiatives and Developments

- 11.16 Vee Technologies

- 11.16.1 Company Overview

- 11.16.2 Key Executives

- 11.16.3 Company snapshot

- 11.16.4 Active Business Divisions

- 11.16.5 Product portfolio

- 11.16.6 Business performance

- 11.16.7 Major Strategic Initiatives and Developments

- 11.17 Infosys Limited

- 11.17.1 Company Overview

- 11.17.2 Key Executives

- 11.17.3 Company snapshot

- 11.17.4 Active Business Divisions

- 11.17.5 Product portfolio

- 11.17.6 Business performance

- 11.17.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Component |

|

By Organization Size |

|

By Service Location |

|

By Industry |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Legal Process Outsourcing Services in 2032?

+

-

Which type of Legal Process Outsourcing Services is widely popular?

+

-

What is the growth rate of Legal Process Outsourcing Services Market?

+

-

What are the latest trends influencing the Legal Process Outsourcing Services Market?

+

-

Who are the key players in the Legal Process Outsourcing Services Market?

+

-

How is the Legal Process Outsourcing Services } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Legal Process Outsourcing Services Market Study?

+

-

What geographic breakdown is available in North America Legal Process Outsourcing Services Market Study?

+

-

Which region holds the second position by market share in the Legal Process Outsourcing Services market?

+

-

Which region holds the highest growth rate in the Legal Process Outsourcing Services market?

+

-