North America Photoacoustic imaging Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-864 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Photoacoustic Imaging (PAI) market focuses on leading-edge biomedical imaging technology that converges the strong optical contrast of light with deep penetration and high spatial resolution capabilities of ultrasound in a unique fashion. The methodology is a hybrid one, with biological tissues exposed to short bursts of laser light. Upon light absorption by the tissues, an instantaneous, local temperature rise ensues, with ultrasonic wave generation as the result. These sound waves are subsequently picked up by ultrasound transducers and processed to generate high-resolution images of the structural, functional, and molecular characteristics of the tissue, providing information on tissue composition, blood flow, oxygenation, and the presence of certain biomarkers without the use of ionising radiation.

The market involves several PAI systems, such as photoacoustic tomography (PAT) for imaging of deeper tissues and photoacoustic microscopy (PAM) for cellular and subcellular high-resolution imaging, and associated elements such as lasers, transducers, and imaging reconstruction and analysis software.

Photoacoustic imaging Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

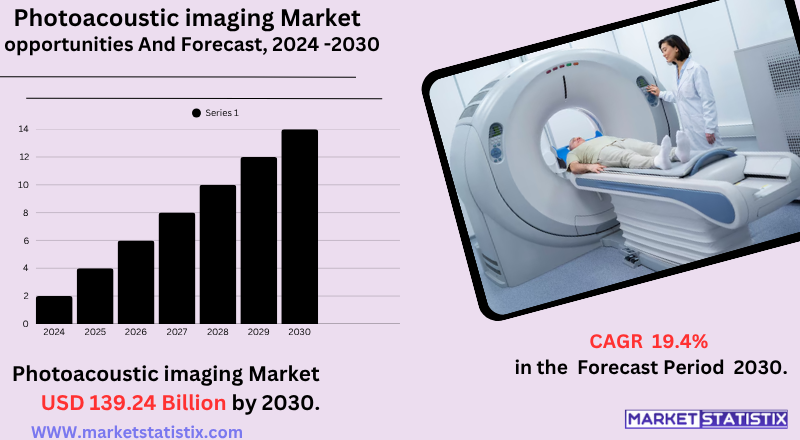

| Growth Rate | CAGR of 19.4% |

| Forecast Value (2030) | USD 139.24 Billion |

| By Product Type | Photoacoustic Tomography, Photoacoustic Microscopy, Intravascular Photoacoustic Imaging |

| Key Market Players |

|

| By Region |

|

Photoacoustic imaging Market Trends

The Photoacoustic Imaging (PAI) industry is expected to see high growth due to a number of underlying trends. One key trend is the growing need for non-invasive and real-time imaging modalities, especially for early disease diagnosis and monitoring response to treatment in conditions such as oncology and cardiology. Technological advancements are also making PAI systems increasingly better in terms of resolution, depth penetration, and sensitivity, and therefore increasingly useful for clinical and preclinical use.

Another leading trend is the growth of PAI in new clinical indications outside its classical applications. The research is keenly investigating its role in dermatology for non-invasive imaging of the skin, in neurology for imaging the brain and vascular studies, and even in musculoskeletal imaging. The advances in sophisticated contrast agents and artificial intelligence for more advanced image analysis and interpretation are also influencing the market. Moreover, the drive towards miniaturisation and the creation of portable PAI systems are anticipated to expand its availability and utilisation in point-of-care applications, further propelling market growth in Kolhapur, Maharashtra, and worldwide.

Photoacoustic imaging Market Leading Players

The key players profiled in the report are illumiSonics Inc. (Canada), Canon (Japan), Echofos Medical (Canada)Endra LifeSciences Inc. (United States), TomoWave (United States), FUJIFILM VisualSonics Inc. (Canada), Prexion (United States), Hitachi Medical Corporation (Japan), Seno Medical Instruments (United States), PA Imaging (Netherlands), Esaote SpA (Italy), Kibero (Germany), VibroniX, Inc. (United States)Growth Accelerators

The Photoacoustic Imaging (PAI) industry is driven by a number of fundamental factors that highlight its increasing significance in medical diagnostics and research. One major driver is the rising incidence of chronic diseases, most notably cancer and cardiovascular diseases. PAI's capacity to deliver high-resolution, real-time images with superior contrast and functional and molecular information renders it extremely useful for early disease detection, monitoring of treatment, and elucidation of disease mechanisms – all of which are critical factors in managing these prevalent diseases in Kolhapur and the world at large.

In addition, ongoing advances in laser technology, ultrasound transducers, and image reconstruction algorithms are greatly expanding the capabilities and clinical usefulness of PAI systems. Technological advancements like multi-wavelength lasers, high-speed scanning methods, and advanced software for image processing are enhancing the quality of images, depth of penetration, and diagnostic precision. Moreover, increasing investments in biomedicine R&D, coupled with growing government support and private sector investment, are promoting the establishment and usage of advanced imaging technologies like PAI, fuelling further growth in the Kolhapur, Maharashtra, and global markets.

Photoacoustic imaging Market Segmentation analysis

The North America Photoacoustic imaging is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Photoacoustic Tomography, Photoacoustic Microscopy, Intravascular Photoacoustic Imaging . The Application segment categorizes the market based on its usage such as Nervous System, Tumor, Lymphatic, Cardiovascular Disease (CVD), Other. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive dynamics of the Photoacoustic Imaging (PAI) market are driven by a mix of niche technology vendors and major medical imaging firms exploring this new technology. No particular company leads the market currently, but active engagement is witnessed by players such as FUJIFILM VisualSonics, iThera Medical, Seno Medical Instruments, and TomoWave Laboratories. These firms are concentrating on making technological innovations that will improve the resolution of images, penetration ability, and establishment of new applications, especially preclinical studies and oncology.

Competition for the PAI market is heating up, fuelled by the technology's singular capability to offer high optical contrast and deep ultrasonic penetration. Major competitive drivers are product innovation, including the development of integrated multi-modal imaging systems, enhancing laser technology for improved performance, and designing sophisticated software for image processing and analysis.

Challenges In Photoacoustic imaging Market

The photoacoustic imaging industry is confronted with a number of key challenges that impede its general clinical uptake. The high cost of equipment is a major hindrance, as sophisticated imaging equipment demands a huge initial outlay and maintenance costs, which may be unaffordable for small healthcare institutions and those in low- and middle-income countries. Moreover, the absence of uniform reimbursement policies for photoacoustic procedures further hinders procurement and integration into routine clinical practice.

There are also non-technical obstacles exacerbating these, such as a lack of standard protocols, scarce regulatory approvals, and a lack of adequate clinical validation, which all delay moving from research into everyday medical practice. The marketplace also struggles with a splintered terminology landscape, generating clinician confusion and making it more difficult to integrate with current clinical data systems. Solving these complex problems will necessitate concerted action in technological advancement, regulatory convergence, cost minimisation, and training of the workforce to maximise the full potential of photoacoustic imaging in clinical diagnosis.

Risks & Prospects in Photoacoustic imaging Market

The market is taking advantage of continued developments in hybrid imaging technologies, growing clinical uses – particularly in oncology and vascular imaging – and increased investments in research and development to enhance diagnostic performance and identify new applications. Strategic alliances, growing regulatory clearances, and the use of artificial intelligence are also driving innovation and adoption further, making photoacoustic imaging an essential technology for early disease diagnosis and personalised medicine.

Region-wise, North America leads the market owing to its superior healthcare infrastructure, high R&D spends, and early embracement of state-of-the-art imaging technologies, especially for cancer diagnosis. Europe comes next, aided by robust government support and high research institution concentration, while the Asia-Pacific market is anticipated to grow at the fastest rate, fuelled by increasing healthcare spending, growing biotechnology and pharmaceutical industries, and growing government support for medical research – most notably in China, Japan, and India. Growing markets like India and Brazil provide further opportunities for growth, driven by better healthcare infrastructure and increasing emphasis on early disease identification and non-invasive diagnostic imaging.

Key Target Audience

,The major target market for the photoacoustic imaging industry includes hospitals, diagnostic imaging centres, and research and academic institutions. Imaging centers and hospitals are implementing photoacoustic imaging systems because they can deliver high-resolution, non-invasive imaging for uses in oncology, cardiology, and neurology. These facilities want advanced diagnostic equipment to improve patient care and treatment outcomes. Scholarship and research institutions are very important in promoting the development of photoacoustic imaging technologies via research and development to drive market growth.

,Secondary stakeholders are the manufacturers of medical devices, regulatory authorities, and investors. Manufacturers are creating and selling photoacoustic imaging systems, transducers, and software to capitalise on the increasing demand. Regulatory authorities enforce the safety and effectiveness of the technology, enabling its integration in the clinical environment. Investors and strategic business analysts pay attention to the market expansion, fuelled by the growing healthcare spending and the incidence of chronic diseases.

Merger and acquisition

New trends in the photoacoustic imaging industry reflect strategic collaborations and technological innovations to upgrade imaging capabilities. In February 2022, FUJIFILM VisualSonics Inc. and PIUR Imaging entered into a strategic collaboration to develop Ultra-High Frequency (UHF) Three-Dimensional (3D) ultrasound technology. This partnership unites FUJIFILM's Vevo MD system with PIUR Imaging's tUS Infinity platform to allow researchers and clinicians to measure and visualise volumes of ultrasound in 3D, thus aiding the evaluation of irregularities in clinical research fields like neurology and dermatology.

Also, in October 2021, iThera Medical GmbH introduced the Incision TRIO preclinical optoacoustic imaging device that includes Transmitted Ultrasound Computed Tomography (TUCT). The device expands the biomedical applications field by allowing flexibility in the imaging of disease processes, delivering reliable images of sound within tissue and its variation with disease-impacted tissues, including cancer. The incorporation of TUCT augments the system's ability to provide information from other modalities, such as multispectral optoacoustic tomography imaging, reflection mode ultrasound, and transmission mode ultrasound, thereby allowing researchers to investigate areas of interest.

>Analyst Comment

The worldwide photoacoustic imaging (PAI) market is growing at a fast pace, fuelled by the increasing incidence of chronic diseases like cancer, cardiovascular, and neurological disorders, as well as growing demand for non-invasive, high-resolution diagnostic imaging. PAI has the advantage of combining the strengths of optical and ultrasound imaging, allowing real-time, deep-tissue visualisation without ionising radiation, making it especially useful in oncology for tumour detection, as well as in neurology and cardiology. The market valued around USD 117–125 million in 2024 will be expected to range between USD 317 million and USD 430 million between 2033. This growth is driven by sustained technological improvement, rising spending on research and development, and expanding clinical usage portfolios.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Photoacoustic imaging- Snapshot

- 2.2 Photoacoustic imaging- Segment Snapshot

- 2.3 Photoacoustic imaging- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Photoacoustic imaging Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Photoacoustic Tomography

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Photoacoustic Microscopy

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Intravascular Photoacoustic Imaging

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Photoacoustic imaging Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cardiovascular Disease (CVD)

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Lymphatic

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Tumor

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Nervous System

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Other

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Photoacoustic imaging Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Canon (Japan)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Echofos Medical (Canada)Endra LifeSciences Inc. (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Esaote SpA (Italy)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 FUJIFILM VisualSonics Inc. (Canada)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Hitachi Medical Corporation (Japan)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 illumiSonics Inc. (Canada)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Kibero (Germany)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 PA Imaging (Netherlands)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Prexion (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Seno Medical Instruments (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 TomoWave (United States)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 VibroniX

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Inc. (United States)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Photoacoustic imaging in 2030?

+

-

Which type of Photoacoustic imaging is widely popular?

+

-

What is the growth rate of Photoacoustic imaging Market?

+

-

What are the latest trends influencing the Photoacoustic imaging Market?

+

-

Who are the key players in the Photoacoustic imaging Market?

+

-

How is the Photoacoustic imaging } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Photoacoustic imaging Market Study?

+

-

What geographic breakdown is available in North America Photoacoustic imaging Market Study?

+

-

Which region holds the second position by market share in the Photoacoustic imaging market?

+

-

How are the key players in the Photoacoustic imaging market targeting growth in the future?

+

-

, In addition, ongoing advances in laser technology, ultrasound transducers, and image reconstruction algorithms are greatly expanding the capabilities and clinical usefulness of PAI systems. Technological advancements like multi-wavelength lasers, high-speed scanning methods, and advanced software for image processing are enhancing the quality of images, depth of penetration, and diagnostic precision. Moreover, increasing investments in biomedicine R&D, coupled with growing government support and private sector investment, are promoting the establishment and usage of advanced imaging technologies like PAI, fuelling further growth in the Kolhapur, Maharashtra, and global markets.,

The Photoacoustic Imaging (PAI) industry is driven by a number of fundamental factors that highlight its increasing significance in medical diagnostics and research. One major driver is the rising incidence of chronic diseases, most notably cancer and cardiovascular diseases. PAI's capacity to deliver high-resolution, real-time images with superior contrast and functional and molecular information renders it extremely useful for early disease detection, monitoring of treatment, and elucidation of disease mechanisms – all of which are critical factors in managing these prevalent diseases in Kolhapur and the world at large.

,

,