North America Positron Emission Tomography Market – Industry Trends and Forecast to 2030

Report ID: MS-872 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The Positron Emission Tomography Market is about manufacturing, distributing, and using PET scanners and radiopharmaceuticals for medical imaging. PET is a nuclear medicine functional imaging method that employs small quantities of radioactive substances, referred to as radiotracers, to identify and quantify metabolic activity, blood flow, and other body functions. By sensing the gamma rays that are produced when positrons (that are emitted by radiotracers) collide with electrons within the body, PET scanners produce high-resolution 3D images of organ and tissue function on a cellular level, yielding important diagnostic information that structural imaging methods such as CT and MRI can't.

The PET market is crucial for the diagnosis, staging, and monitoring of numerous diseases, especially in oncology, neurology, and cardiology. In oncology, PET scans are critical for detecting and staging cancers, monitoring response to treatment, and identifying recurrence. In neurology, PET is applied to examine brain function, diagnose neurological disorders such as Alzheimer's and Parkinson's disease, and localise seizure foci in epilepsy.

Positron Emission Tomography Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

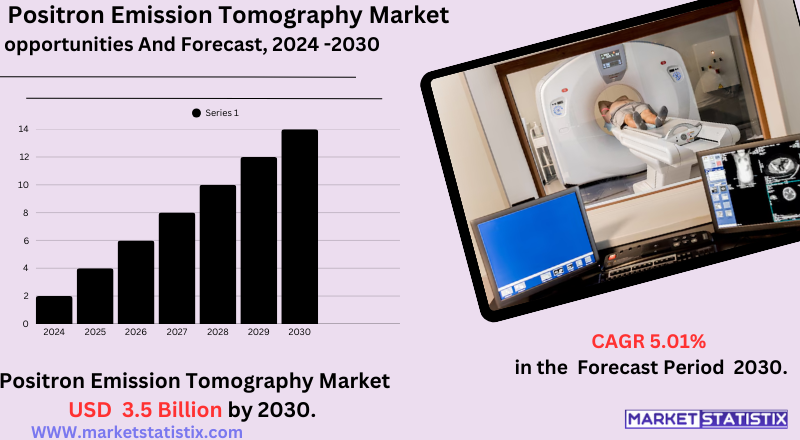

| Growth Rate | CAGR of 5.01% |

| Forecast Value (2030) | USD 3.5 Billion |

| By Product Type | PET-MR, PET-CT, Other |

| Key Market Players |

|

| By Region |

|

Positron Emission Tomography Market Trends

The Positron Emission Tomography (PET) industry is also experiencing a number of major trends that are influencing its development and future evolution. One of the major trends is the growing incorporation of PET into other imaging modalities, including Computed Tomography (CT) and Magnetic Resonance Imaging (MRI), to produce hybrid PET/CT and PET/MRI systems. The hybrid systems give both functional and anatomical information, greatly improving diagnostic accuracy and efficiency, particularly in oncology, neurology, and cardiology.

Another major trend is the fast growth of the radiopharmaceuticals market with the creation of new and more specific PET tracers. The new tracers aim to image certain biological processes and disease biomarkers, resulting in more accurate and earlier disease diagnosis for diseases such as prostate cancer, neuroendocrine tumours, and Alzheimer's disease. More investment in the production and research of PET tracers is enhancing their availability and clinical value. Use of PET in novel areas such as theranostics, the merger of diagnostic imaging with targeted radionuclide therapy, is also increasing pace and promises great value to personalised medicine.

Positron Emission Tomography Market Leading Players

The key players profiled in the report are Topgrade HealthCare, Philips Healthcare, GE, Hitachi, Toshiba, Neusoft Corporation, Siemens Healthcare, United ImagingGrowth Accelerators

The growth of the Positron Emission Tomography (PET) market is largely driven by the growing incidence of chronic illnesses worldwide, notably cancer, neurological conditions such as Alzheimer's and Parkinson's disease, and cardiovascular diseases. PET imaging is imperative in the diagnosis of these ailments at an early stage, the precise staging of the diseases, and monitoring for effective treatment outcomes, which is why PET scanning and radiopharmaceutical demand increase. In addition, the growing geriatric population, which is more prone to these conditions, also adds a significant amount to market growth as PET scans increasingly become required for diagnosis and treatment in this group.

Technologies like digital PET scanners, advanced detector technology for increased sensitivity and resolution, and reduced scanning times enhance image quality and patient comfort. Furthermore, the incorporation of artificial intelligence (AI) algorithms enhances interpretation and analysis of images, further enhancing the efficacy and efficiency of PET imaging in clinical applications.

Positron Emission Tomography Market Segmentation analysis

The North America Positron Emission Tomography is segmented by Type, Application, and Region. By Type, the market is divided into Distributed PET-MR, PET-CT, Other . The Application segment categorizes the market based on its usage such as Neurology, Cancer Treatment, Cardiology. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market competition in the Positron Emission Tomography (PET) sector is held by a number of large-scale players across the world who make high investments in developing technology and possess wide-ranging product portfolios. Such prominent companies are Siemens Healthineers, GE Healthcare, and Philips Healthcare. They compete based on the aspects of image quality, scan speed, dose of radiation, and the combination of advanced software and artificial intelligence to improve diagnostics. The market is also confronted by competition from other major players such as Canon Medical Systems and Mediso, creating a concentrated yet competitive atmosphere.

Competition is also strengthened by the growing need for hybrid imaging systems, including PET/CT and PET/MRI, that offer functional as well as anatomical information. Firms are emphasising the creation of more sensitive systems, higher resolution, and broader clinical uses, especially in oncology, neurology, and cardiology. Strategic alliances, new product launches, and the creation of new radiotracers are the main strategies that firms use in order to differentiate themselves in this expanding market.

Challenges In Positron Emission Tomography Market

The positron emission tomography (PET) industry is confronted with great challenges, mainly because of the expensive nature of PET scanners and their use. The initial capital investment to purchase a PET scanner can be anywhere from hundreds of thousands to several million dollars, and the annual operating costs impose an additional financial burden. These expenses frequently render PET technology unaffordable for small hospitals and healthcare institutions, particularly in developing countries, restricting patient access and hindering market penetration.

Other significant issues are regulatory and reimbursement hurdles and supply-related logistical issues concerning radiotracers. Strict regulatory approval procedures for novel radiopharmaceuticals and PET imaging systems can retard market access and limit the uptake of innovative solutions. The limited half-life of most PET tracers necessitates proximity to specialised production sites, making distribution difficult and restricting the extent of PET imaging, especially in rural or underprivileged communities. In addition, fear of radiation exposure and availability shortages of qualified professionals to run PET equipment and interpret images also serve as strong brakes on market expansion. Therefore, surmounting these economic, regulatory, and logistical challenges is still key to wider adoption and expansion of PET technology globally.

Risks & Prospects in Positron Emission Tomography Market

The increasing incidence of chronic diseases, an ageing population, and rising healthcare spending are driving demand, complemented by increased awareness among patients and medical professionals. Moreover, research and development, positive reimbursement policies, and the growth of healthcare infrastructure are driving market growth.

Geographically, North America leads the PET market with the highest share because of its well-developed healthcare infrastructure, high healthcare expenditure, and strong base of leading imaging technology companies. The United States, in specific, gains from strong investments in nuclear medicine and a high prevalence of chronic diseases that need PET imaging. Europe also has a significant share, fuelled by increasing chronic disease prevalence and growing healthcare spending. While that is happening, the Asia Pacific region is also expected to develop at the highest CAGR, driven by a fast-growing ageing population, increased awareness of imaging procedures, and increasing healthcare facilities in nations such as China, India, and South Korea. Emerging economies in Latin America, the Middle East, and Africa are also anticipated to experience high growth as healthcare infrastructure and access to advanced imaging technologies increase.

Key Target Audience

The Positron Emission Tomography (PET) market is targeted mainly at healthcare providers, such as hospitals, surgical centers, diagnostic imaging clinics, and research institutions. The largest end-users are hospitals and surgical centers, which represent around 60% of the market share in 2023. These centers use PET imaging for diagnosing and monitoring diseases like cancer, neurological disorders, and cardiovascular diseases.

,,

, Patients, especially individuals with chronic illnesses or receiving cancer treatment, are the immediate beneficiaries of PET services. The growing incidence of chronic illness, together with technological advances in imaging technology, spurs the demand for PET scanning. The ageing population further fuels the demand for early and precise diagnosis. In India, for example, the healthcare industry consisting of hospitals represented 80% of the overall healthcare market in 2023, representing a great opportunity for PET service providers to gain wider appeal and serve the increasing patient population.

Merger and acquisition

In August 2024, Siemens Healthineers revealed that it had acquired Advanced Accelerator Applications' molecular imaging business from Novartis for more than €200 million. The move is strategic in that it will enhance Siemens' positron emission tomography (PET) capabilities by acquiring a critical supply of Fluorine-18, a radioactive isotope used in cancer diagnostics. AAA has Europe's second-largest cyclotron network, which enables the manufacture of radiopharmaceuticals for PET scans. The transaction is anticipated to strengthen Siemens Healthineers' position in the European market, especially in the expanding space of radioligand therapy for cancer therapy. This move is part of a larger consolidation trend in the PET market as firms aim to consolidate upstream supply chains and widen diagnostic portfolios.

With the purchase of AAA's diagnostics business, Siemens Healthineers not only acquires access to key radiopharmaceuticals but also enhances its alliance with Novartis in radioligand therapy. It highlights the rising significance of PET imaging in cancer and the strategic advantage of ensuring stable supplies of radiotracers to serve expanding clinical demand.

Analyst Comment

The worldwide positron emission tomography (PET) market is witnessing consistent growth due to an increase in incidence rates of long-term diseases, including cancer, neurological diseases, and cardiovascular diseases, as well as vast technological advancements in imaging modalities. Market size estimates differ, but the 2024 value is estimated by most sources to be between USD 1.26 billion and USD 2.1 billion, reaching around USD 1.94 billion to USD 2.01 billion by 2033. The use of hybrid imaging systems such as PET/CT and PET/MRI, which give both anatomical and functional data, is also improving diagnostic accuracy and further broadening the clinical applications of PET scans.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Positron Emission Tomography- Snapshot

- 2.2 Positron Emission Tomography- Segment Snapshot

- 2.3 Positron Emission Tomography- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Positron Emission Tomography Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 PET-CT

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 PET-MR

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Other

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Positron Emission Tomography Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cancer Treatment

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Neurology

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Cardiology

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Positron Emission Tomography Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 GE

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Hitachi

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Neusoft Corporation

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Philips Healthcare

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Siemens Healthcare

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Toshiba

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Topgrade HealthCare

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 United Imaging

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Positron Emission Tomography in 2030?

+

-

Which type of Positron Emission Tomography is widely popular?

+

-

What is the growth rate of Positron Emission Tomography Market?

+

-

What are the latest trends influencing the Positron Emission Tomography Market?

+

-

Who are the key players in the Positron Emission Tomography Market?

+

-

How is the Positron Emission Tomography } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Positron Emission Tomography Market Study?

+

-

What geographic breakdown is available in North America Positron Emission Tomography Market Study?

+

-

Which region holds the second position by market share in the Positron Emission Tomography market?

+

-

How are the key players in the Positron Emission Tomography market targeting growth in the future?

+

-

The growth of the Positron Emission Tomography (PET) market is largely driven by the growing incidence of chronic illnesses worldwide, notably cancer, neurological conditions such as Alzheimer's and Parkinson's disease, and cardiovascular diseases. PET imaging is imperative in the diagnosis of these ailments at an early stage, the precise staging of the diseases, and monitoring for effective treatment outcomes, which is why PET scanning and radiopharmaceutical demand increase. In addition, the growing geriatric population, which is more prone to these conditions, also adds a significant amount to market growth as PET scans increasingly become required for diagnosis and treatment in this group.

,

,, Technologies like digital PET scanners, advanced detector technology for increased sensitivity and resolution, and reduced scanning times enhance image quality and patient comfort. Furthermore, the incorporation of artificial intelligence (AI) algorithms enhances interpretation and analysis of images, further enhancing the efficacy and efficiency of PET imaging in clinical applications.