North America Project Scheduling Software Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1015 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

Project planning software market refers to the industry segment that offers digital solutions specially designed to organise, track and manage timelines, resources and deliveries associated with projects. These software tools help organizations to streamline workflows, improve collaboration and improve general efficiency by providing real-time visibility in project status, resource allocation, deadlines and potential bottlenecks. Primarily used across various sectors such as construction, IT, health services and production, project planning software solutions enable managers to dynamically adjust schedules, predict conflicts, optimise resource use and maintain continuous adaptation between team members, which significantly reduces the project's delays and ensures smooth project execution.

Project Scheduling Software Report Highlights

| Report Metrics | Details |

|---|---|

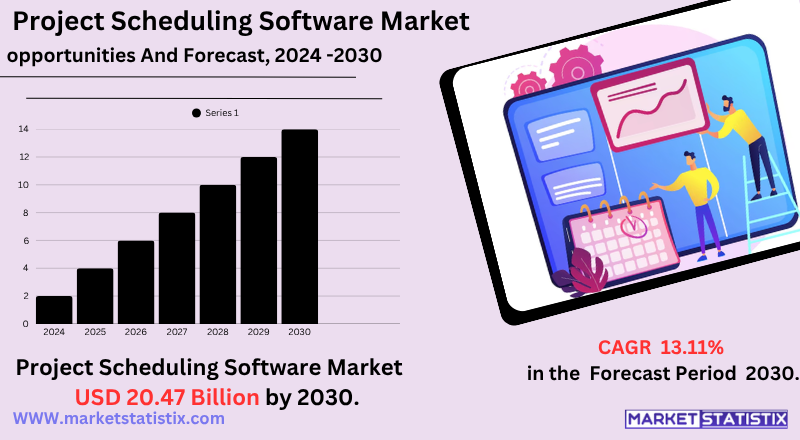

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 13.11% |

| Forecast Value (2030) | USD 20.47 Billion |

| By Product Type | Cloud-Based, On-Premise |

| Key Market Players |

|

| By Region |

|

Project Scheduling Software Market Trends

The project scheduling software market is currently experiencing significant growth, driven by the growing complexity of projects between the sectors and the broad adoption of remote and hybrid work models. Main trends include a strong demand for cloud-based solutions that offer real-time collaboration and accessibility, rapid AI integration and automation for predictive analysis and allocation of optimised resources, and a growing focus on intuitive and user-friendly interfaces. Organisations, especially small and medium enterprises, are increasingly seeking these solutions to increase efficiency, reduce costs and improve the overall success of the project.

Project Scheduling Software Market Leading Players

The key players profiled in the report are Notion (United States), Smartsheet (United States), Microsoft (United States), Jira (Australia), Trello (United States), Asana (United States, Click Up (United States), Monday (Israel), Workfront (United States), Airtable (United States, Wrike (United States)Growth Accelerators

- Rapid digital transformation and cloud adoption: Organizations are increasingly changing project programming tools on site to cloud, designed by flexibility, scalability and reducing the change-on change is expanding the market significantly.

- Growth in remote/hybrid work and distributed teams: Increased hybrid and remote work models has boosted demand for real -time collaborative scheduling platforms that provide visibility, coordination and perfect communication between geographies.

- Integration of AI, automation & advanced analytics: Improved with AI and ML, modern tools offer predictive analysis, automated task management and smarter resource allocation - increasing project results and promoting a broad adoption of companies

Project Scheduling Software Market Segmentation analysis

The North America Project Scheduling Software is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cloud-Based, On-Premise . The Application segment categorizes the market based on its usage such as Time Tracking, Work Schedule Management, Employee Communication, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The project scheduling software market is intensely competitive, with major players such as Microsoft (Project), Oracle (Primavera), Atlassian (Jira), Zoho (Projects), Asana, Monday.com, Smartsheet and Wrike that dominate the landscape. The market is currently experiencing significant growth, driven by the increasing complexity of projects, the widespread adoption of external and hybrid work models, and the growing demand from small and medium-sized companies (SMEs) for efficient and scalable solutions. An important trend is the rapid integration of AI and automation for predictive analysis, risk assessment, optimised resource allocation and automated workflows. Cloud-based solutions are also very preferred because of their accessibility and real-time collaborative skills. The focus is on giving centralised visibility, extensive reporting and customizable dashboards to enable data-driven decision-making and improve the general project efficiency in different industries, including IT, construction and production.

Challenges In Project Scheduling Software Market

- Data privacy, security & compliance pressures: Scheduling platforms deal with sensitive project and personal data, facing rigid regulations such as GDPR, HIPAA and global equivalents. Ensure safe encryption, function-based access, and real-time threat mitigation add complexity and cost.

- Integration complexity with legacy systems: Many organizations depend on outdated or isolated infrastructure with limited APIs, making it difficult to integrate modern scheduling tools. This usually leads to project delays, increased customisation costs and fragmented data flows.

- High implementation and total cost burden for SMEs: AI state scheduling tools, automation and advanced analysis usually come with sharp configuration and signature rates. This price structure places them out of the reach of SMEs, reducing adoption and creating a demand gap.

Risks & Prospects in Project Scheduling Software Market

The project scheduling software market is currently seeing significant opportunities driven by the growing complexity of projects, the wide adoption of remote and hybrid work models and the growing demand for efficient resource management. Real-time collaboration, predictive analysis by AI and machine learning and perfect integration with other corporate tools, such as ERP and CRM systems, are key areas of growth. Companies, including a rapid expansion segment of small and medium enterprises, are actively looking for cloud-based intuitive solutions that offer improved data security, customizable features, and mobile accessibility to optimise workflows, reduce risk and improve the overall project delivery.

Key Target Audience

The project scheduling software market is intensely competitive, with major players such as Microsoft (Project), Oracle (Primavera), Atlassian (Jira), Zoho (Projects), Asana, Monday.com, Smartsheet and Wrike that dominate the landscape. The market is currently experiencing significant growth, driven by the increasing complexity of projects, the widespread adoption of external and hybrid work models, and the growing demand from small and medium-sized companies (SMEs) for efficient and scalable solutions. An important trend is the rapid integration of AI and automation for predictive analysis, risk assessment, optimised resource allocation and automated workflows. Cloud-based solutions are also very preferred because of their accessibility and real-time collaborative skills. The focus is on giving centralised visibility, extensive reporting and customizable dashboards to enable data-driven decision-making and improve the general project efficiency in different industries, including IT, construction and production.

Merger and acquisition

- Smartsheet taken private by Blackstone & Vista Equity Partners (~$8.4 B deal): This signifies a strong rebound in software acquisition, with PE companies paying $56.50 per share (an 8.5% premium) and a 45-day go‑shop window ending November 2024, marking one of the largest PE deals in work‑management software.

- 2ndWave Software acquires JAMS scheduling solution: PSG-supported 2ndWave purchased JAMS (workload automation and job scheduling tools) directly from TA Associates, signalling consolidation in the planning/automation niche.

- FinTech and SaaS sectors driving ecosystem M&A amid rising PE interest: Wider consolidation in SaaS – powered by AI and PE capital – increases M&A in adjacent workflows as project planning and creates both vertical and horizontal integration opportunities.

Analyst Comment

The project scheduling software market is undergoing significant growth, driven by the growing complexity of projects, the wide adoption of remote and hybrid work models and the growing demand for allocation of efficient resources and real-time tracking. Several in approximately US $7.24 billion by 2025, the market is expected to reach about $12.02 billion by 2030. The main factors include the need for seamless collaboration between geographically scattered teams and AI integration and automation for predictive risk analysis and management.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Project Scheduling Software- Snapshot

- 2.2 Project Scheduling Software- Segment Snapshot

- 2.3 Project Scheduling Software- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Project Scheduling Software Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cloud-Based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 On-Premise

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Project Scheduling Software Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Work Schedule Management

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Employee Communication

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Time Tracking

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Project Scheduling Software Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Airtable (United States

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Asana (United States

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Click Up (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Jira (Australia)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Microsoft (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Monday (Israel)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Notion (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Smartsheet (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Trello (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Workfront (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Wrike (United States)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Project Scheduling Software in 2030?

+

-

Which application type is expected to remain the largest segment in the North America Project Scheduling Software market?

+

-

How big is the North America Project Scheduling Software market?

+

-

How do regulatory policies impact the Project Scheduling Software Market?

+

-

What major players in Project Scheduling Software Market?

+

-

What applications are categorized in the Project Scheduling Software market study?

+

-

Which product types are examined in the Project Scheduling Software Market Study?

+

-

Which regions are expected to show the fastest growth in the Project Scheduling Software market?

+

-

Which application holds the second-highest market share in the Project Scheduling Software market?

+

-

What are the major growth drivers in the Project Scheduling Software market?

+

-

- Rapid digital transformation and cloud adoption: Organizations are increasingly changing project programming tools on site to cloud, designed by flexibility, scalability and reducing the change-on change is expanding the market significantly.

- Growth in remote/hybrid work and distributed teams: Increased hybrid and remote work models has boosted demand for real -time collaborative scheduling platforms that provide visibility, coordination and perfect communication between geographies.

- Integration of AI, automation & advanced analytics: Improved with AI and ML, modern tools offer predictive analysis, automated task management and smarter resource allocation - increasing project results and promoting a broad adoption of companies