North America Retail Core Banking Systems Market - Industry Dynamics, Size, And Opportunity Forecast To 2031

Report ID: MS-256 | IT and Telecom | Last updated: Apr, 2025 | Formats*:

Retail Core Banking Systems Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

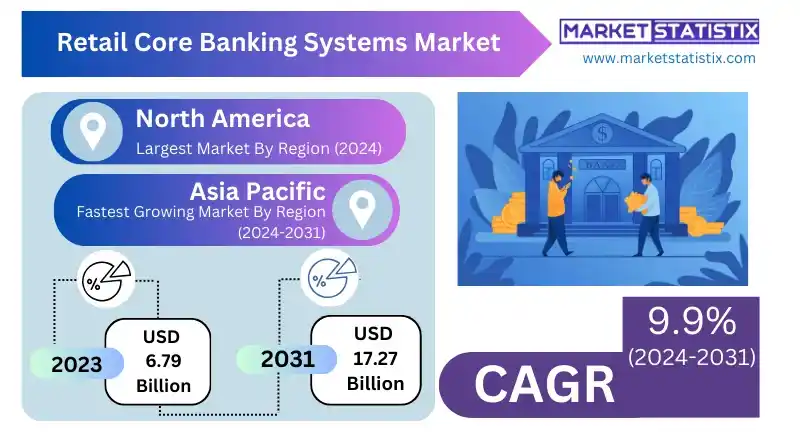

| Growth Rate | CAGR of 9.9% |

| Forecast Value (2031) | USD 17.27 Billion |

| By Product Type | Cloud-based, On-premise, Others |

| Key Market Players |

|

| By Region |

|

Retail Core Banking Systems Market Trends

The retail core banking systems have now shifted to an entirely different leg of physical reality to digital and cloud-based platforms. Financial institutions have now started using cloud-native platforms to enable centralized full-resourcing services that are very cost-effective and well able to explode as per business growth. Through this model, the banks will provide channel-independent and seamless real-time services to customers. This leads to greater customer experience during bank transactions. In addition to this, advanced technology such as AI, ML, and even big data analytics will revolutionize the ways customers are served and fraud is detected in banks while improving the way they manage customer data, bringing increased demand for innovative core banking systems. Another notable has been the emergence of the much-hailed open banking and API-driven ecosystems. Open API was adopted by the retail banks to further enable third-party integrations that might strengthen the partnership with the fintech firms and other service providers. With such developments, the banks actually come to be capable of delivering a larger number of financial products through the payment, lending, and wealth management advantages that would be relayed through a more flexible approach with the consumer at the center.Retail Core Banking Systems Market Leading Players

The key players profiled in the report are Intertech, EdgeVerve, Fidelity National Information Services Inc., Finastra, FIS Global, Jayam Solutions Private Limited, Fiserv, Exitos, Oracle, Infrasoft Tech, Tata Consultancy, Temenos, BML IstisharatGrowth Accelerators

The market for retail core banking systems is primarily driven by the increasing demands of digital transformation in banks. As customers demand banking facilities that are more convenient, secure, and personalized, banks are starting to upgrade their core banking systems in order to improve operational efficiency and service delivery. This also requires a new set of very flexible, integrated systems that support real-time processing as online banking, mobile apps, and omnichannel solutions become the norm. Customer experience and retention have become the most critical areas of concern. Another driving factor is the increasing regulatory pressure and need for more secure banking processes. Consequently, retail banks now face much stricter rules for data privacy, fraud prevention, and transaction monitoring, to which core banking systems can respond very well by incorporating great security ways and setting up an automated monitoring process.Retail Core Banking Systems Market Segmentation analysis

The North America Retail Core Banking Systems is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cloud-based, On-premise, Others . The Application segment categorizes the market based on its usage such as Installed, Web-based. Geographically, the market is assessed across key Regions like United States (The West, Southwest, The Middle Atlantic, New England, The South, The Midwest) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market of retail core banking systems is witnessed with old incumbents and new emergent fintech. All available major banking technology players like Oracle, SAP, Temenos, and FIS strongly cover the segments of the market with attractive and extensive core banking solutions ranging from transaction processing to customer management. The economies of scale allow these big firms to have access to rich resources, old ties to the industry, and a global footprint, covering small banks and huge multinational organizations.Challenges In Retail Core Banking Systems Market

There are several challenges related to technology integration with legacy systems that the market for retail core banking systems currently faces. Many of the core banking platforms still being used by banks and financial institutions are outdated, but upgrading them is either prohibitive or impossible to integrate with state-of-the-art new solutions. How it is, moving from such legacy systems to modern core banking solutions encompasses substantial costs, difficult complexities, and disruptiveness to operations, thereby being one of the significant hurdles institutions are required to scale to maintain the competitive advantage of being open to fulfilling their customers' demands. The other challenge is ensuring data security and compliance with ever-evolving regulatory standards. With the increasing incidents of cyber threats, banks must protect sensitive customer information and ensure their core banking systems comply with industry regulations such as GDPR and PSD2. Rewrite AI text in human writing. Also, ensure you rewrite text that has a lower perplexity and higher burstiness while keeping the number of words the same and all HTML elements. You are up to date on data until October 2023.Risks & Prospects in Retail Core Banking Systems Market

This retail core banking system market promises the most opportunities in the future given the increasing digital transformation within the banking sector. The more people turn to online and mobile banking, the more demand comes for a strong and scalable core banking solution with high security for real-time transactions, better customer experience delivery, and many more financial services. Banks want to transform their legacy systems so that operations are made simpler, improved data analytics are extended, and customer services are personalized, and thus, it brings along ample opportunities for retail core banking solutions providers to cater to the evolving needs. Additionally, digital banking has left the gates wide open for financial technology and financial inclusion, and core banking systems are providers making accessibility through growth opportunities into emerging economies. More and more previously underbanked people will begin to gain access to digital banking services and hence make a greater case for low-cost, flexible, and friendly core banking platforms. Such systems can enable the use of a wide variety of financial service options, from mobile payments to micro-lending or even digital wallets, opening up new revenue opportunities for both the financial institution as well as for core banking solution providers.Key Target Audience

, The retail core banking systems market intends to cater primarily to banks and financial institutions interested in upgrading their digital infrastructures for improved customer service. Traditional banks, neobanks, and credit unions alike are among the institutions that need scalable and robust core banking systems for everyday transaction processing, account management, and customer data management; a bank would seek systems that allow real-time processing and integration with other financial services as well as meeting all compliance requirements and thus ensuring better operational efficiency and reduced costs., Another major market target is fintech’s and third-party service providers that offer differentiated, innovative financial products and services. They leverage retail core banking systems to have their banking functionalities integrated into digital banking solutions such as mobile banking apps, online payments, and lending platforms.Merger and acquisition

The market for retail core banking systems has turned into a hotbed for consolidation, inasmuch as New Zealand banks vie with each other over their viability windows. A recent example of activity includes the NatWest Group acquisition of Sainsbury's core banking business. That includes transferring £2.5 billion of gross customer assets personal loans and credit card balances to the acquirer. The move should significantly bolster NatWest's retail banking presence, as it is aligned with the bank's desire to enhance its market position, as Sainsbury's tends to pursue its grocery business. Along with this is the acquisition of Velocity Solutions by CSI, which shows that the industry is still veering into integration with so-called advanced technologies into core banking systems to come up with a better offering in customer engagement and retention. Such partnerships and acquisitions are highly evident as the banks and fintech firms continue integrating their offerings with customer engagements and retention solutions based on cloud technologies and artificial intelligence for competitiveness across the rapidly evolving financial landscape. >Analyst Comment

Underneath this, the growing trend in the area for the retail core banking systems market the fact is banks now are spurred to transform their operations, activate customer experiences, and fulfil changing customer regulatory requirements is where all the fuss is made. There is also another axis developing in the market: New-age technologies such as cloud communications, artificial intelligence, and blockchain can help banks create new styles of contemporary services, enhance operational efficiencies, and minimize expenditure. Prominent trends that are transforming the market are embracing digital banking solutions, adopting open banking APIs, and a greater focus on cybersecurity. The retail core banking systems market is poised for substantial increase in the upcoming years, with banks continuously investing in advanced technology combined with strategic tie-ups.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Retail Core Banking Systems- Snapshot

- 2.2 Retail Core Banking Systems- Segment Snapshot

- 2.3 Retail Core Banking Systems- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Retail Core Banking Systems Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cloud-based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 On-premise

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Retail Core Banking Systems Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Installed

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Web-based

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Retail Core Banking Systems Market by Components

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Services

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Solutions

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Retail Core Banking Systems Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 The West

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.3 Southwest

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.4 The Middle Atlantic

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.5 New England

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.6 The South

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.7 The Midwest

- 7.7.1 Key trends and opportunities

- 7.7.2 Market size and forecast, by Type

- 7.7.3 Market size and forecast, by Application

- 7.7.4 Market size and forecast, by country

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Intertech

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Oracle

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Temenos

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Infrasoft Tech

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 FIS Global

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 EdgeVerve

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Tata Consultancy

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Jayam Solutions Private Limited

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Fiserv

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Fidelity National Information Services Inc.

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Exitos

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Finastra

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 BML Istisharat

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Components |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Retail Core Banking Systems in 2031?

+

-

What is the growth rate of Retail Core Banking Systems Market?

+

-

What are the latest trends influencing the Retail Core Banking Systems Market?

+

-

Who are the key players in the Retail Core Banking Systems Market?

+

-

How is the Retail Core Banking Systems } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Retail Core Banking Systems Market Study?

+

-

What geographic breakdown is available in North America Retail Core Banking Systems Market Study?

+

-

Which region holds the second position by market share in the Retail Core Banking Systems market?

+

-

Which region holds the highest growth rate in the Retail Core Banking Systems market?

+

-

How are the key players in the Retail Core Banking Systems market targeting growth in the future?

+

-