North America Semiconductor Gases Market – Industry Trends and Forecast to 2032

Report ID: MS-653 | Energy and Natural Resources | Last updated: Mar, 2025 | Formats*:

Semiconductor Gases Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

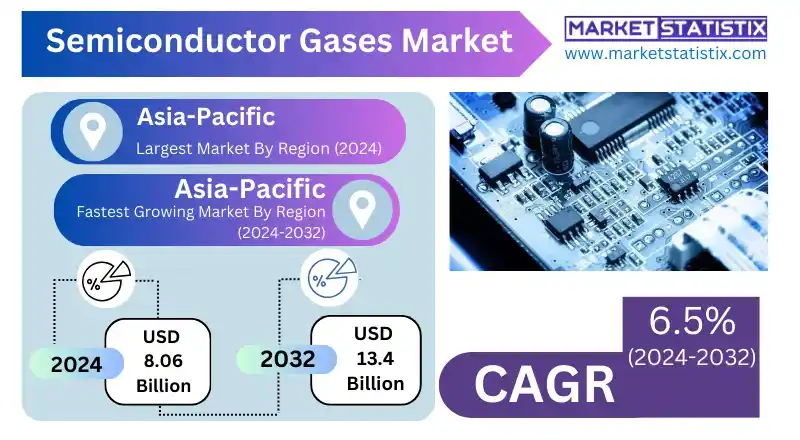

| Growth Rate | CAGR of 6.5% |

| Forecast Value (2032) | USD 13.4 Billion |

| By Product Type | Electronic Specialty Gases, Bulk Gases |

| Key Market Players |

|

| By Region |

|

Semiconductor Gases Market Trends

Such trends are the consumption of different specialty gases, which form a critical part of advanced deposition and etching processes used in next-generation semiconductor manufacturing. Miniaturization (chip performance improvement) necessitates ultra-high purity gases. This results in heavy investments in purification and quality control. Moreover, more 3D NAND and EUV lithography technologies have also been adopted with a consequent need for some specific gases, such as rare gases and precursors. Another emerging trend relates to a growing focus on metrology that is increasingly sustainable and environmentally friendly. It would include the advent of gases that would induce lower global warming potential alongside emission reduction and improved recycling and reusage technologies. On-site gas generation systems are also becoming an important trend, thus reducing transport costs and ensuring improved supply chain reliability. On the whole, the future outlook of the market remains at a great moment, given its strong tie with the innovation and expansion rates of the semiconductor industry.Semiconductor Gases Market Leading Players

The key players profiled in the report are Messer Group (Germany), Air Liquide (France), American Gas Products (U.S.), Air Products and Chemicals Inc. (U.S.), Iwatani Corporation (Japan), Electronic Fluorocarbons LLC (U.S.), Linde plc (U.K.), SUMITOMO SEIKA CHEMICALS CO. LTD. (Japan), Solvay (Belgium), SHOWA DENKO K.K. (Japan), Taiyo Nippon Sanso JFP Corporation (Japan)Growth Accelerators

The semiconductor gases market is primarily driven by the relentless advancement and expanding application of semiconductor technologies. The increasing complexity of integrated circuits, coupled with the demand for miniaturization and enhanced performance, necessitates the use of high-purity gases in fabrication processes. The proliferation of electronic devices across various sectors, including consumer electronics, automotive, and telecommunications, fuels the demand for semiconductor chips, consequently driving the need for specialized gases. Furthermore, the burgeoning growth of emerging technologies like artificial intelligence, 5G networks, and the Internet of Things (IoT) significantly contributes to the market's expansion, as these applications rely heavily on advanced semiconductor components.Semiconductor Gases Market Segmentation analysis

The North America Semiconductor Gases is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Electronic Specialty Gases, Bulk Gases . The Application segment categorizes the market based on its usage such as Manufacturing, Testing, Packaging, Others. Geographically, the market is assessed across key Regions like United States (The West, Southwest, The Middle Atlantic, New England, The South, The Midwest) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The semiconductor gases market is characterized by very high specialization and stringent quality requirements, thus giving the arena for competition to very few corporations. Major companies like Air Liquide, Air Products and Chemicals, Inc., and Linde plc have the proper infrastructure and expertise to produce and distribute ultra-high-purity gases. The competition, therefore, focuses on the consistent quality of supply and development of innovative gas solutions catering to the changing needs of the semiconductor manufacturer. Long-term supply agreements and joint ventures with leading semiconductor fabricators are vital for obtaining market share. Regional factors also add to the dynamics, as Asia-Pacific is a large market mostly because of the concentration of semiconductor manufacturing facilities. There is an emphasis on expanding within the region and appealing to local market conditions.Challenges In Semiconductor Gases Market

The challenges primarily facing the semiconductor gases market are stringent environmental regulations and serious supply chain vulnerabilities. For example, there is growing criticism of gases like fluorinated compounds, which are necessary in the semiconductor industry. However, how these gases affect the environment puts a lot of pressure on the industry at present because significant investments must be made in emission control technologies, which eventually translates to high operational costs. The industry not only experiences supply chain interruptions but also critical gases like helium. The growing importance of helium for the semiconductor industry because of its growing demand due to double usage as cooling and background gases will almost be doubled by 2035. Such an increase will only aggravate the constraint in supply, especially given that helium is limited and has its sources subjected to geopolitical tensions involving key suppliers such as Russia and Qatar. These challenges highlight the importance of strategic planning to ensure a regular and sustainable supply of critical semiconductor gases.Risks & Prospects in Semiconductor Gases Market

The surge of electric vehicles and green manufacturing offers opportunities for suppliers to innovate ecological gas applications. Major players' strategic investments in R&D will further enhance such opportunities and enable the development of state-of-the-art products to cater to emerging semiconductor manufacturing trends. Asia-Pacific is the leading and fastest-growing region in the semiconductor gases market due to a sophisticated electronics manufacturing ecosystem and rising investment in semiconductor fabrication plants. China, South Korea, and Taiwan drive this growth with their high demand for advanced gases. North America still plays an important market, supported by technological innovations and government support for semiconductor research. The same applies to Europe, which plays a big part due to its focus on sustainable manufacturing. Meanwhile, some emerging markets in Latin America and the Middle East & Africa remain largely untapped as industries expand their semiconductor capabilities.Key Target Audience

The semiconductor gases market itself is primarily oriented toward integrated device manufacturers (IDMs) and semiconductor foundries that require ultra-high-purity gases to be used in processes like deposition, etching, doping, and chamber cleaning for the best chip performance and yield. In 2024, at least 25 major manufacturing facilities worldwide reported advanced adoption of in-house purification systems to achieve near-trace-level contaminant detection, an indication of a growing urgency for gas with a consistent and contaminant-free supply.,, Another interesting market segment consists of fabless semiconductor companies that design chips and outsource their manufacturing to foundries. These companies work closely with the foundries to ensure availability of specialized gases, which are needed in the production of advanced semiconductor devices. The increasing complexity of chip architectures due to applications of high-performance computing, 5G networking, and artificial intelligence presents an even greater demand for specialized semiconductor gases. This correlates to an even more central role of the market in enabling the advancement of technology in different sectors.Merger and acquisition

The semiconductor gases market has been significantly consolidated through activities such as mergers and acquisitions, demonstrating the underlying strategic intention of a company to develop capabilities and gain presence in the marketplace. In September 2023, the strategic acquisition by Air Liquide S.A. of a major specialty gas supplier for semiconductor applications reinforced the associate's portfolio and technological knowledge in advanced semiconductor fabrication. The development is envisaged to facilitate operational timelines and gain cost efficiencies while allowing Air Liquide to competitively price its products and services. In the same context, another acquisition, completed in July 2022, saw Entegris acquire CMC Materials Inc. for $5.7 billion, thereby expanding its product portfolio and complementing the company's global leadership in electronic materials to fulfil growing semiconductor needs. Hence, these strategic aspects have positioned the consolidation trend in the industry as companies seek enhanced technological capabilities to cater to the evolving needs of semiconductor manufacturers. >Analyst Comment

The semiconductor gases market is experiencing significant growth due to the ever-increasing demand for advanced semiconductor devices for different sectors such as consumer electronics, the automotive industry, and telecommunications. Key market drivers include the growing complexity of semiconductor fabrication processes, the rise in the adoption of advanced technologies like 5G and AI, along with the continued miniaturization of electronic components. This market is characterized by stringent purity requirements and concentrated effort in developing specialized gases suitable for new-age manufacturing techniques.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Semiconductor Gases- Snapshot

- 2.2 Semiconductor Gases- Segment Snapshot

- 2.3 Semiconductor Gases- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Semiconductor Gases Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Electronic Specialty Gases

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Bulk Gases

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Semiconductor Gases Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Manufacturing

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Packaging

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Testing

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Semiconductor Gases Market by Process

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Deposition

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Etching

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Doping

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Semiconductor Gases Market by End-User

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Integrated Device Manufacturers

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Foundries

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Others

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Semiconductor Gases Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 The West

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.3 Southwest

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.4 The Middle Atlantic

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.5 New England

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.6 The South

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.7 The Midwest

- 8.7.1 Key trends and opportunities

- 8.7.2 Market size and forecast, by Type

- 8.7.3 Market size and forecast, by Application

- 8.7.4 Market size and forecast, by country

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 American Gas Products (U.S.)

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Electronic Fluorocarbons LLC (U.S.)

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Messer Group (Germany)

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Air Liquide (France)

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Air Products and Chemicals Inc. (U.S.)

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Linde plc (U.K.)

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Solvay (Belgium)

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 SUMITOMO SEIKA CHEMICALS CO. LTD. (Japan)

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 SHOWA DENKO K.K. (Japan)

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Iwatani Corporation (Japan)

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Taiyo Nippon Sanso JFP Corporation (Japan)

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Process |

|

By End-User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Semiconductor Gases in 2032?

+

-

How big is the North America Semiconductor Gases market?

+

-

How do regulatory policies impact the Semiconductor Gases Market?

+

-

What major players in Semiconductor Gases Market?

+

-

What applications are categorized in the Semiconductor Gases market study?

+

-

Which product types are examined in the Semiconductor Gases Market Study?

+

-

Which regions are expected to show the fastest growth in the Semiconductor Gases market?

+

-

Which region is the fastest growing in the Semiconductor Gases market?

+

-

What are the major growth drivers in the Semiconductor Gases market?

+

-

Is the study period of the Semiconductor Gases flexible or fixed?

+

-