North America Smart Retail Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-276 | Chemicals And Materials | Last updated: Dec, 2024 | Formats*:

Smart Retail Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

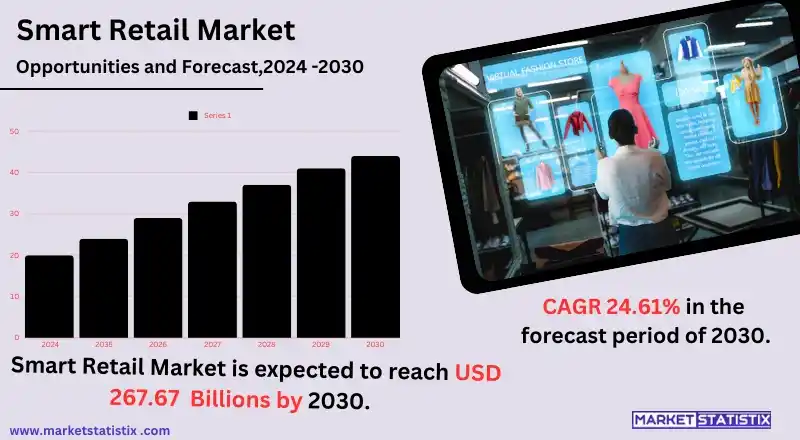

| Growth Rate | CAGR of 24.61% |

| Forecast Value (2031) | USD 267.67 Billion |

| By Product Type | Hardware, Software |

| Key Market Players |

|

| By Region |

Smart Retail Market Trends

The adoption of advanced technologies like AI, IoT, and big data analytics in smart retail transformation is very fast changing the conventional retail world. Automated kiosks, smart shelves, and personalised shopping experiences based on data have been some general trends in smart retail. These have also resulted in customers increasingly using smart devices and sensors for better inventory management, customer engagement, and operational efficiency. The changes in preference over being contactless while shopping and the whole experience of in-store retail, especially during and post-COVID-19, have led to the increased adaptation of smart retail solutions. With e-commerce and omnichannel retail booming, the impact of smart retail solutions will also be felt as these integrate offline and online channels. The adoption of AR and VR technology to forge immersive shopping experiences is at its peak for these tech-savvy consumers. As retailers make sustainability a priority today, green technologies are being integrated into their smart retail platform, which would also boost the market growth.Smart Retail Market Leading Players

The key players profiled in the report are Amazon.com, Inc., Cisco Systems, Inc., Google LLC, NVIDIA Corporation, NXP Semiconductors, PAX Global Technology Limited, Samsung Electronics, Verifonestem Sys, Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Ingenico, Fiserv, Inc., Intel Corporation, LG Display Co., Ltd., NCR CorporationGrowth Accelerators

The evolving smart retail market is driven by the rising demand for enhanced customer experiences and operational efficiencies. Retailers are adopting smart technologies, like IoT, AI, and other automation technologies, to optimise warehouse inventories, personalise service offerings, and streamline operational activities. Besides the growing trend of e-commerce, brick-and-mortar store retailers integrate smart solutions with the likes of smart shelves and self-checkout systems as well as advanced data analytics for attracting and retaining customers to bring their businesses in line with their competitors in e-commerce. Collectively, all these technologies provide real-time data gathering and better decision-making, resulting in consumer satisfaction and increased sales. Convenience and connectivity are perhaps the most important factors driving the consumer shopping experience. Most consumers have taken to expecting much quicker, more personalised service, including AI recommendation tools for specific products, virtual try-ons, and automated checkout systems, to mention a few. An increasing scale of adoption in mobile payment systems and other contactless transactions is invariably making that journey incomparably less complicated.Smart Retail Market Segmentation analysis

The North America Smart Retail is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Hardware, Software . The Application segment categorizes the market based on its usage such as Retail, automation. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Smart retail markets have traditionally comprised competition between two well-established retail giants, several established technology providers, and emergent startups. These entities strive towards leading enterprises in emerging technologies such as AI, IoT, and automation. Such biggies include the likes of Amazon, Walmart, and Alibaba, with all their efforts consequently boosting the integration of these technologies into their retail businesses, including checkout-free shopping, personalised shopping experiences, and built-in inventory management modules. In addition, companies like IBM, Google, and Microsoft are also key players in the market. They have developed solutions that use AI to enable customer engagement, predictive analytics, and supply chain efficiency for organizations. Competition continues to thrive since organisations have invested heavily in digital transformation, thus keeping up with the increased demand for seamless and touchless shopping experiences.Challenges In Smart Retail Market

The application of the new-age technologies such as artificial intelligence, the Internet of Things, and data analytics in the smart retail market adds a new challenge for the market in terms of growth hindrances. The high cost involved in the implementation of these systems is one of the challenges. Most small and medium retailers are not able to afford the cost involved in hardware, software, and infrastructure to support advanced systems and tools, let alone having to maintain a competent workforce to manage all that infrastructure. Even with these challenges, another common problem pertains to most retailers that hinders the integration of these technologies into their operations. Undoubtedly, another significant obstacle for many retailers is the issue of data privacy and security threats that accompany the financial impact brought by smart retail solutions concerning the collection, analysis, and refurbishment of consumers' data; these threats have raised questions about retail preparedness to tackle an avalanche of breaches and privacy violations. Furthermore, shifting legislation and rising consumer awareness on data protection complicate the issue.Risks & Prospects in Smart Retail Market

However, an important opportunity lies with the smart retail market, which is driven mainly by the growing demand for innovative technologies that improve the shopping experience. Connecting an Internet of Things (IoT) and Artificial Intelligence (AI) with big data analytics gives the business a different perspective in customer interaction, stock handling, and customisation of offers. Consumers have shifted their focus toward a well-connected, personalised, and more convenient shopping experience, which prompted retailers to provide solutions such as automated checkout, intelligent pricing, and interactive displays to improve efficiency and customer satisfaction. There are also factors such as the strong focus on contactless solutions in shopping post-COVID, which continue to open avenues for innovation in the smart retail domain. Smart technologies like augmented reality (AR) and virtual reality (VR) and AI-enabled customer service agents add to the benefits of in-store and online shopping by creating a sense of engagement and retention in customers. Rapidly growing use of smart devices and wearable technologies further adds to the demand for smart retail solutions.Key Target Audience

The prime target of the smart retail market is made up of both retailers and consumers. You have retailers inclusive of the following: huge retail chains, supermarkets, convenience stores, and online platforms. Most of these retailers are adopting smart retail solutions for enhanced customer experiences, optimised operations, and increased sales. Such retailers look for advanced technologies such as artificial intelligence, IoT, and data analytics, which can bring about personalisation into the shopping experience, better inventory management, and supply chain optimization.,, On the other end of the consumer spectrum are tech-savvy shoppers looking for convenience and personal experiences and intimate brand interaction. The smart retail market is an attraction to customers who are seeking new shopping experiences like contactless payment methods, AI-driven personal recommendations, and even virtual try-outs. Millennials and Gen Z drive the majority of this trend because they appreciate technological integration, fast service, and a greater degree of personalisation.Merger and acquisition

The smart retail market has been marked by strategic mergers and acquisitions to enhance technological capability and market coverage. In this, an important move is Instacart's acquisition of Caper AI in October 2021, which broadened Instacart's retailer enablement platform through the application of AI-powered solutions that enhance experiences in-store and online shopping. This movement shows how companies are shifting towards advanced technologies for efficiency in operations while meeting demands. Likewise, the purchase of Phos by Ingenico, as well as Missfresh Limited buying Zailouxia, are yet more examples of how highly competitive the industry is as organisations try to build their service portfolio and improve operational efficiencies in the smart retail setting. For instance, Barcodes Inc. acquiring Smart Label Solutions is aimed at further advancements for better inventory management and operational efficiency through superior labelling technology. All these acquisitions not only have been indicative of consolidation in the industry but also underscore the need to innovate new solutions like IoT, AI, and blockchain in order to remain competitive in the rapidly changing landscape. >Analyst Comment

"The world smart retail market is experiencing tremendous growth because of the following causes: the increasing adoption of e-commerce, a rising demand for personalisation, and the necessity for operational efficiency for retailers. In fact, technology and data are applied for the betterment of shopping experiences among consumers while also enabling retailers to run their operations more smoothly. The smart retail industry has bright prospects and is expected to be at its peak in the next few years, as there is a large number of retailers adopting smart technologies, such as artificial intelligence, the Internet of Things, augmented reality, and big data analytics, to retain competitiveness and provide their customers with a more seamless and engaging shopping experience."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Smart Retail- Snapshot

- 2.2 Smart Retail- Segment Snapshot

- 2.3 Smart Retail- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Smart Retail Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hardware

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Software

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Smart Retail Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Retail

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 automation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Amazon.com

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Inc.

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Cisco Systems

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Inc.

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Google LLC

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 NVIDIA Corporation

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 NXP Semiconductors

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 PAX Global Technology Limited

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Samsung Electronics

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Verifonestem Sys

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Honeywell International Inc.

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Huawei Technologies Co.

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Ltd.

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 IBM Corporation

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Ingenico

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Fiserv

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Inc.

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Intel Corporation

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 LG Display Co.

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 Ltd.

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 NCR Corporation

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Smart Retail in 2031?

+

-

Which type of Smart Retail is widely popular?

+

-

What is the growth rate of Smart Retail Market?

+

-

What are the latest trends influencing the Smart Retail Market?

+

-

Who are the key players in the Smart Retail Market?

+

-

How is the Smart Retail } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Smart Retail Market Study?

+

-

What geographic breakdown is available in North America Smart Retail Market Study?

+

-

Which region holds the second position by market share in the Smart Retail market?

+

-

Which region holds the highest growth rate in the Smart Retail market?

+

-