North America Supply Chain Analytics Software Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2032

Report ID: MS-396 | Consumer Goods | Last updated: Feb, 2025 | Formats*:

Supply Chain Analytics Software Report Highlights

| Report Metrics | Details |

|---|---|

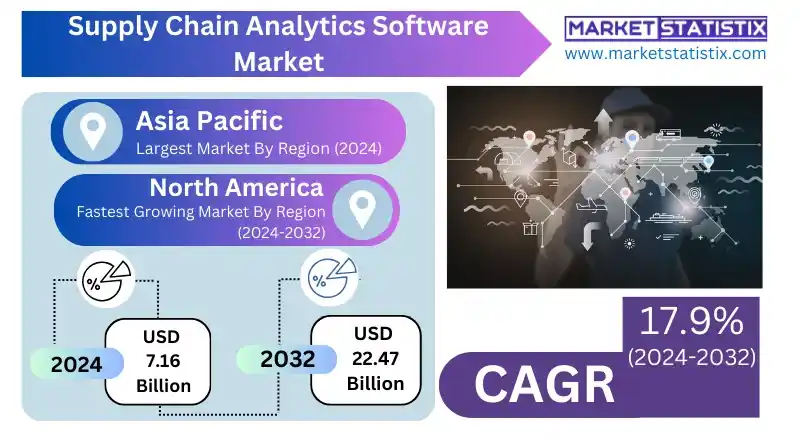

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 17.9% |

| Forecast Value (2032) | USD 22.47 Billion |

| Key Market Players |

|

| By Region |

|

Supply Chain Analytics Software Market Trends

Demand for supply chain analytics software is witnessing a sharp rise due to the growing complexities of global supply chains and an urgent need for organizations to be ahead of competitors. A trend that is critical at this time is the growing inclination of a cloud-based solution that provides scalability, flexibility, and cost reduction compared to on-premise solutions. This trend is especially suited to small and medium enterprises (SMEs) that prefer investing in advanced analytics instead of making huge upfront investments. Furthermore, we also see a major trend in the integration of artificial intelligence (AI) and machine learning (ML) into analytical software for supply chain management. Better demand forecasting, proactive risk management, and auto-decision-making of AI and ML tools all lead to enhanced efficiency and resilience of the supply chain. AI-powered insights are being adopted by businesses to optimise inventory levels and logistics and to minimise possible disruptions, thereby increasing the demand for sophisticated solutions for supply-chain analytics.Supply Chain Analytics Software Market Leading Players

The key players profiled in the report are Tableau Software Inc., IBM Corporation, SAS Institute Inc., Manhattan Associates Inc., MicroStrategy Inc., Genpact, SAP SE, Accenture PLC, Oracle Corporation, JDA Software Group Inc.Growth Accelerators

There are several growth factors impacting the supply chain analytics software market. The first factor is the increasing complexity of global supply chains. The second factor that forces organizations to adopt analytics solutions for optimisation is the emergence of ecommerce and omnichannel activities that intensify competition, thus rendering effective management of supply chains a primary differentiator. Companies need to integrate analytics into their respective businesses in areas such as demand forecasting, inventory management, and logistics efficiency to ensure timely deliveries and customer satisfaction. On top of it, big data proliferation and advanced analytics technologies like artificial intelligence and machine learning are increasingly enabling enterprises to extract insights from their supply chain data and use these insights proactively to take decisions, mitigate risks, and continuously improve across the supply chain. Demand is also increasing for analytics solutions that can track and monitor sustainability and ethical sourcing compliance and responsible business practices.Supply Chain Analytics Software Market Segmentation analysis

The North America Supply Chain Analytics Software is segmented by and Region. . Geographically, the market is assessed across key Regions like United States (The West, Southwest, The Middle Atlantic, New England, The South, The Midwest) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The supply chain analytics software category is characterised by a panoply of unique players, comprising an odd mix of established giants and emerging specialists. Established players such as SAP, Oracle, and IBM offer fully integrated suites with their ERP systems and serve as businesses' one-stop shops. These companies are able to utilise enormous amounts of resources and brand equity to capture the attention of larger enterprises that have multifaceted supply chain requirements. However, there is also strong competition emerging from the smaller players such as Blue Yonder (formerly JDA Software), Kinaxis, and LLamasoft, who are focused on only one area, such as demand planning, optimisation, or network design. These companies tend to provide more specialised solutions that have advanced analytics capabilities that attract enterprises in search of targeted improvement in specific areas of their supply chain. This dynamic environment has engendered innovation as players continuously try to introduce innovative solutions incorporating AI, machine learning, and real-time visibility to keep in tune with the market trends.Challenges In Supply Chain Analytics Software Market

The supply chain analytics software market is emergent, and it still has a lot of challenges. The first problem is how to capture the data for quality-tested and integrated applications. Very large volumes of data are produced from multiple supply chain sources, most times with inconsistencies and errors that make it almost impossible to clean, standardise, and integrate for use in accurate analysis. The other problem is a shortage of skilled resources. Most of the time, operating any supply chain analytics application requires relevant skill set expertise involving data science, supply chain, and implementation software. Hence, carrying out a hunt to get the professionals and retain them becomes very difficult, causing bottlenecks for many companies. It becomes a barrier to entry, as strengthening they would mostly drain towards mis-use of software and is inhibitive to advantages that accrue from implementation and returns on investments.Risks & Prospects in Supply Chain Analytics Software Market

The supply chain analytics software market presents several compelling opportunities for growth and innovation. One key opportunity lies in the increasing adoption of cloud-based solutions. Cloud deployment offers scalability, flexibility, and cost-effectiveness, making advanced analytics accessible to a wider range of businesses, including small and medium-sized enterprises (SMEs) that may have previously been limited by budget constraints. This trend allows vendors to cater to a broader customer base and drive market expansion.Key Target Audience

The focus audience for supply chain analytics is businesses that literally cater to all segments of supply chains, namely manufacturers, merchants, distributors, and almost all third-party logistic service providers who are keen on improving their operations, reducing costs, and becoming more effective and efficient. They employ supply chain analytics on their operations to be visible in their inventory levels, transportation routes, and supplier performance, as well as other important metrics, in an attempt to apply their improved data towards planning, sourcing, producing, and delivering.,, In these organizations, the popular players and users of supply chain analytics software are supply chain managers, logistics directors, operations analysts, and procurement professionals. Since these employees are dealing with various spheres of the supply chain, they use insights provided by the software to identify bottlenecks, optimise processes, and achieve better overall supply chain performances. From their end, data-driven insights should enhance visibility, promote better collaboration with partners, and mitigate risk across the entire supply chain.Merger and acquisition

Recently, activities in mergers and acquisitions of various supply chain analytics software have reflected upon its dynamic nature. In October 2024, Descartes Systems Group acquired Sellercloud with the intent to bolster e-commerce capabilities and enhance the customer base. In another incident in March 2024, Blue Yonder acquired One Network Enterprises for $839 million with the intention of strengthening the digital supply chain network offerings. In December 2024, Logility Supply Chain Solutions explored the potential sale of its business with the help of Lazard to find buyers, including private equity-backed tech firms. This fact marks the continuation of the consolidation process in supply chain analytics. Also, in December 2024, Kpler announced its acquisition of Spire Maritime for $241 million to boost its maritime data analytics. These transactions illustrate one of the industry's efforts to harness data analytics and AI to optimise supply chain operations according to market demands. >Analyst Comment

Profound growth engendered by increased complexity of global supply chains and the necessity for optimisation of operations has been visible in the supply chain analytics software market. Companies produce a huge bulge of data in their supply chains; naturally, the necessity for engaging high-end tools to analyse this data and derive actionable insights has arisen. Hence, suddenly, demand for supply chain analytics software has soared, which in turn will help companies in creating efficiencies by cutting costs and managing risks.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Supply Chain Analytics Software- Snapshot

- 2.2 Supply Chain Analytics Software- Segment Snapshot

- 2.3 Supply Chain Analytics Software- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Supply Chain Analytics Software Market by Solution

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Logistics Analytics

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Manufacturing Analytics

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Planning & Procurement

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Sales & Operations Analytics

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Visualization & Reporting

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Supply Chain Analytics Software Market by Service

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Professional

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Support & Maintenance

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Supply Chain Analytics Software Market by Deployment

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Cloud

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 On-premise

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Supply Chain Analytics Software Market by Enterprise Size

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Large Enterprise

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Small & Medium Enterprises

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Supply Chain Analytics Software Market by End-use

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Retail & Consumer Goods

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Healthcare

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Manufacturing

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Transportation

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

- 8.6 Aerospace & Defense

- 8.6.1 Key market trends, factors driving growth, and opportunities

- 8.6.2 Market size and forecast, by region

- 8.6.3 Market share analysis by country

- 8.7 High Technology Products

- 8.7.1 Key market trends, factors driving growth, and opportunities

- 8.7.2 Market size and forecast, by region

- 8.7.3 Market share analysis by country

- 8.8 Others

- 8.8.1 Key market trends, factors driving growth, and opportunities

- 8.8.2 Market size and forecast, by region

- 8.8.3 Market share analysis by country

9: Supply Chain Analytics Software Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 The West

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.3 Southwest

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.4 The Middle Atlantic

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.5 New England

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.6 The South

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.7 The Midwest

- 9.7.1 Key trends and opportunities

- 9.7.2 Market size and forecast, by Type

- 9.7.3 Market size and forecast, by Application

- 9.7.4 Market size and forecast, by country

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 SAS Institute Inc.

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 Oracle Corporation

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 Manhattan Associates Inc.

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Genpact

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 MicroStrategy Inc.

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 Tableau Software Inc.

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 SAP SE

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Accenture PLC

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 IBM Corporation

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 JDA Software Group Inc.

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Solution |

|

By Service |

|

By Deployment |

|

By Enterprise Size |

|

By End-use |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Supply Chain Analytics Software in 2032?

+

-

What is the growth rate of Supply Chain Analytics Software Market?

+

-

What are the latest trends influencing the Supply Chain Analytics Software Market?

+

-

Who are the key players in the Supply Chain Analytics Software Market?

+

-

How is the Supply Chain Analytics Software } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Supply Chain Analytics Software Market Study?

+

-

What geographic breakdown is available in North America Supply Chain Analytics Software Market Study?

+

-

Which region holds the second position by market share in the Supply Chain Analytics Software market?

+

-

Which region holds the highest growth rate in the Supply Chain Analytics Software market?

+

-

How are the key players in the Supply Chain Analytics Software market targeting growth in the future?

+

-