North America Transcriptomics Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-884 | Manufacturing and Construction | Last updated: May, 2025 | Formats*:

The transcriptomics market is concerned with the exploration of the transcriptome, which is the total set of RNA transcripts of an organism's genome under a given condition. This entails the study of RNA level, variation, and function in deciphering gene expression and regulation. By looking at the transcriptome, scientists can find out which genes are turned on or off in various cells, tissues, or stages of development, and how these patterns alter in reaction to different stimuli, diseases, or drug therapies. Transcriptomics fills the gap between genomics (the study of DNA) and proteomics (the study of proteins) and gives a dynamic picture of cellular activity.

The technologies propelling the transcriptomics market are sophisticated sequencing technologies such as RNA-Seq (RNA sequencing), microarrays, and quantitative PCR (qPCR). These technologies allow for exhaustive profiling of all RNA molecules within a sample, including messenger RNA (mRNA), which contains protein-coding information, and numerous non-coding RNAs with regulatory roles. The market involves instruments, consumables, data analysis software, and services for transcriptomic studies.

Transcriptomics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

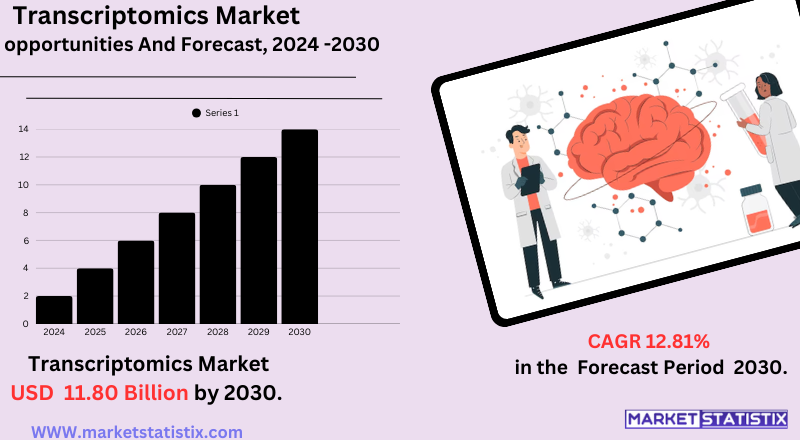

| Growth Rate | CAGR of 12.81% |

| Forecast Value (2030) | USD 11.80 Billion |

| By Product Type | Real-time PCR, Microarray, Sequencing Technology [Sanger Sequencing, RNA-Sequencing] |

| Key Market Players |

|

| By Region |

|

Transcriptomics Market Trends

A few dominant trends are defining its development. One is the growing adoption of single-cell RNA sequencing (scRNA-seq) technologies. This technology enables researchers to study gene expression at the single-cell level, offering unparalleled information on cellular heterogeneity in diverse biological processes and diseases, such as cancer and neurological disorders. The possibility of deconstructing complex tissues and detecting rare populations of cells is greatly enhancing the demand for scRNA-seq.

Yet another significant trend is the fast emergence and utilisation of spatial transcriptomics. In contrast to conventional transcriptomics, which sacrifices spatial information, these techniques permit the study of gene expression in whole tissues, charting where particular genes are turned on. This is significant for the comprehension of tissue structure, cell-cell relationships, and disease development in their natural habitat. New developments in spatial technologies are acquiring greater resolution, multiplexing (the ability to examine more genes at one time), and integration with protein analysis, broadening their application in diagnostics and research further.

Transcriptomics Market Leading Players

The key players profiled in the report are QIAGEN (Exiqon) (Germany) F. Hoffmann-La Roche Ltd. (Switzerland), Merck & Co., Inc., Agilent Technologies, Bio-Rad Laboratories, Inc.Fluidigm Corporation, Illumina, Inc., Promega Corporation, GE Healthcare Dharmacon Inc., Thermo Fisher Scientific Inc.Growth Accelerators

The market of transcriptomics is driven by a number of important factors that reflect its increasing relevance in biological research and medicine. The first of these is the increased demand for personalised medicine. Transcriptomics offers key insights into the individual gene expression profiles, thereby allowing targeted drugs and diagnostic tools to be developed that are aligned with a patient's own molecular profile. This is especially true in fields such as oncology, where knowledge of the individual transcriptome of a tumour can inform treatment and enhance patient outcomes.

Second, the technology advancements in sequencing technologies, such as Next-Generation Sequencing (NGS) and single-cell RNA sequencing, are revolutionising the capability and accessibility of transcriptomic analysis. These technologies present higher throughput, resolution, and cost-effectiveness, enabling scientists to analyse gene expression at a previously unseen scale and at the single-cell level. This nuanced information is extremely useful for deciphering intricate biological processes, disease mechanisms, and the discovery of potential drug targets, additionally driving the growth of the market.

Transcriptomics Market Segmentation analysis

The North America Transcriptomics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Real-time PCR, Microarray, Sequencing Technology [Sanger Sequencing, RNA-Sequencing] . The Application segment categorizes the market based on its usage such as Diagnostics & Disease Profiling, Drug Discovery, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for transcriptomics is highly competitive in nature, with a mix of established life science titans and newer, specialised firms that are innovative in nature. The main areas of competition are the creation of more sensitive and precise sequencing technology (such as RNA-Seq), innovation in microarray platforms, and the formation of powerful and easy-to-use bioinformatics tools for analysing and interpreting data. Firms are also competing to provide end-to-end solutions, involving reagents, instruments, software, and services, that can address the varied needs of researchers and clinicians.

In addition, a major trend is the greater emphasis on single-cell transcriptomics and spatial transcriptomics, which deliver improved resolution information on gene expression at the single-cell level and in tissue context, respectively. This has spurred the development of firms dedicated to these cutting-edge technologies. Collaborations, partnerships, and acquisitions are also prevalent approaches as firms seek to broaden their technology platforms and market coverage.

Challenges In Transcriptomics Market

The market for transcriptomics is confronted by a number of major challenges that limit its wider adoption and expansion. Exorbitant costs involved in the use of advanced sequencing platforms, reagents, and maintenance are a significant hindrance, especially for small and medium-sized research organizations and those from developing nations. The requirement for highly trained individuals to handle complicated instruments and analyse large-scale data also contributes to operational costs. Moreover, the intricacy of handling, storing, and analysing large volumes of transcriptomic data necessitates highly developed bioinformatics equipment and personnel, which are not necessarily available globally.

Regulatory and ethical barriers also pose significant challenges to the transcriptomics market. Translating transcriptomics-based diagnostics and therapies into clinical practice requires overcoming stringent regulatory approvals, large validation studies, and conformity with dynamic international guidelines, which can slow product development and market access. In addition, data privacy, security issues, and the absence of established standards for data analysis make integration into precision medicine and clinical practice challenging. These are key challenges that need to be overcome for innovation to be enabled and ensure the benefits of transcriptomics technologies are captured across research and healthcare sectors.

Risks & Prospects in Transcriptomics Market

The combination of transcriptomics with other 'omics' technologies (such as genomics and proteomics) and the establishment of sophisticated bioinformatics tools to analyse data are opening up new research and clinical opportunities. Emerging economies with growing healthcare investments and an expanding emphasis on R&D also hold huge untapped market opportunities.

Geographically, North America is the global leader in transcriptomics market share, thanks to large investments in R&D, biotech industry majors' presence, and high uptakes of cutting-edge sequencing technology. Europe ranks second, thanks to high governmental support and collaborative research programmes, followed by the Asia-Pacific market, which is the fastest-growing market, driven by China, Japan, and India's high growth, government-supported biotechnology initiatives, and declining sequencing costs. Latin America and the Middle East & Africa are also increasingly becoming potential markets, fuelled by growing research work and healthcare investments, although they are still a smaller percentage of the overall market.

Key Target Audience

, Moreover, contract research organizations (CROs) are a large segment of the transcriptomics industry. CROs offer expert services in the analysis of transcripts, assisting pharmaceutical and biotech firms in their research and development processes. Their services are important in carrying out large-scale studies and clinical trials, providing cost-saving measures and data interpretation expertise. The need for CRO services is on the rise as companies outsource complicated transcriptomic analyses so that they can speed up their research timelines and save on operating costs.,

The market for transcriptomics is mainly focused on biotechnology and pharmaceutical businesses, research and academic institutes, and clinical labs. Biotech and pharmaceutical businesses use transcriptomic techniques to speed up drug discovery and development to discover new therapeutic targets and how diseases work. Academic and research institutes concentrate on investigating gene expression profiles to increase knowledge in genomics and molecular biology. Clinical laboratories use transcriptomics for the diagnosis and personalised treatment of medicine for the right disease profiling and treatment planning. The market for transcriptomics has seen high levels of merger and acquisition (M&A) activity, an indication of the dynamic nature of the industry and strategic actions taken by leading players to augment their technological capabilities and markets. One such instance is the acquisition by Bruker Corporation, in April 2024, of NanoString Technologies for $392.6 million. This acquisition came on the heels of NanoString's Chapter 11 bankruptcy in February 2024, enabling Bruker to bring NanoString's spatial transcriptomics platforms, including the GeoMx Digital Spatial Profiler, into its portfolio and better position itself in spatial omics and translational research. Alongside acquisitions, strategic partnerships have also been instrumental in driving transcriptomics technologies. For example, in January 2024, Agilent Technologies revealed a partnership with Incyte to create and sell haematology and oncology portfolios, taking advantage of Agilent's capabilities in companion diagnostics. These types of collaborations tend to accelerate the development of targeted treatments and personalised medicine strategies. These M&A transactions and partnerships highlight the sector's emphasis on innovation and incorporation of sophisticated technologies to address the rising demand for thorough transcriptomic analysis in research and clinical use. The world transcriptomics market is experiencing robust growth, fuelled by swift technology advances in next-generation sequencing (NGS), expanding use of personalised medicine, and a jump in genomic studies funding. The industry stood at around USD 7.6 billion in 2024 and is expected to reach USD 12.1 billion by 2033, driven primarily by the dominance of North America due to strong healthcare infrastructure, high R&D investments, and strong biotech and pharma industries. The drivers are increasing demand for biomarker identification, growth of transcriptomics-based diagnostics, and increasing application in drug discovery and disease management.

,, Merger and acquisition

Analyst Comment

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Transcriptomics- Snapshot

- 2.2 Transcriptomics- Segment Snapshot

- 2.3 Transcriptomics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Transcriptomics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Microarray

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Real-time PCR

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Sequencing Technology [Sanger Sequencing

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 RNA-Sequencing]

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Transcriptomics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Diagnostics & Disease Profiling

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Drug Discovery

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Others

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Transcriptomics Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 QIAGEN (Exiqon) (Germany) F. Hoffmann-La Roche Ltd. (Switzerland)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Agilent Technologies

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Bio-Rad Laboratories

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Inc.Fluidigm Corporation

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 GE Healthcare Dharmacon Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Illumina

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Inc.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Merck & Co.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Inc.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Promega Corporation

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Thermo Fisher Scientific Inc.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Transcriptomics in 2030?

+

-

Which type of Transcriptomics is widely popular?

+

-

What is the growth rate of Transcriptomics Market?

+

-

What are the latest trends influencing the Transcriptomics Market?

+

-

Who are the key players in the Transcriptomics Market?

+

-

How is the Transcriptomics } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Transcriptomics Market Study?

+

-

What geographic breakdown is available in North America Transcriptomics Market Study?

+

-

Which region holds the second position by market share in the Transcriptomics market?

+

-

How are the key players in the Transcriptomics market targeting growth in the future?

+

-

,,

The market of transcriptomics is driven by a number of important factors that reflect its increasing relevance in biological research and medicine. The first of these is the increased demand for personalised medicine. Transcriptomics offers key insights into the individual gene expression profiles, thereby allowing targeted drugs and diagnostic tools to be developed that are aligned with a patient's own molecular profile. This is especially true in fields such as oncology, where knowledge of the individual transcriptome of a tumour can inform treatment and enhance patient outcomes.

, Second, the technology advancements in sequencing technologies, such as Next-Generation Sequencing (NGS) and single-cell RNA sequencing, are revolutionising the capability and accessibility of transcriptomic analysis. These technologies present higher throughput, resolution, and cost-effectiveness, enabling scientists to analyse gene expression at a previously unseen scale and at the single-cell level. This nuanced information is extremely useful for deciphering intricate biological processes, disease mechanisms, and the discovery of potential drug targets, additionally driving the growth of the market.