Global Woven Carpet and Rug Market Trends and Forecast to 2030

Report ID: MS-538 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Woven Carpet and Rug Report Highlights

| Report Metrics | Details |

|---|---|

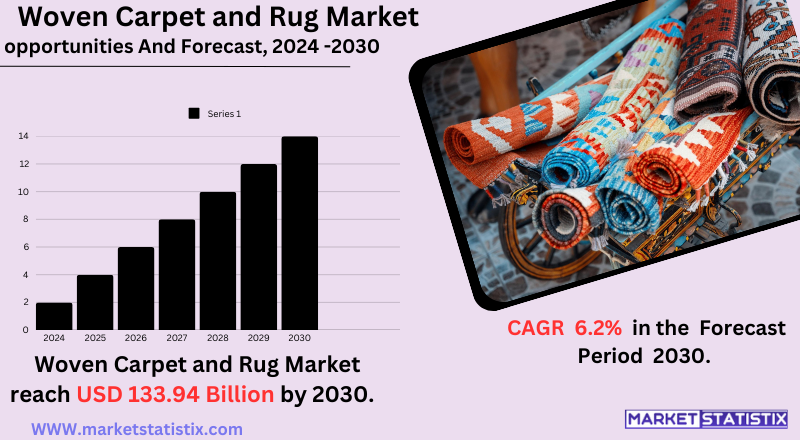

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 6.2% |

| Forecast Value (2030) | USD 133.94 Billion |

| By Product Type | Woven, Tufted, Needle-punched, Knotted |

| Key Market Players |

|

| By Region |

Woven Carpet and Rug Market Trends

The woven carpet and rug market has been experiencing a transformation that has, and will continue, to occur due to changing consumer needs and advancements in technology. Digitisation forges the blueprints of the future in this sector, utilising virtual reality devices to visualise the rugs in their space while broadening retail online catalogue access to a few styles. The casual demand for ripcovers goes back to the era of traditional artisan and handmade rugs, with the consumer interested in that kind of artistry affecting culture. Customisation and personalisation will become distinguishing features among consumers clamouring for custom-made rugs that meet their design specifications. Technology integration into manufacturing techniques increases efficiency and enables the implementation of more complex patterns routing. The influence of interior design trend categories on the market, such as minimalist and bohemian, also shifted towards limited colours, patterns, and textures demanded for a specific population.Woven Carpet and Rug Market Leading Players

The key players profiled in the report are Infloor, Brintons, Dixie Group, HUADE Group, Dinarsu, Atlas Carpet Mills, Jiangsu Kaili Carpet, Balta, Haima Carpet, Interface, TY Carpet, COC Carpet, Dongsheng Carpet Group, Merinos, Mohawk, Milliken, Shenzhen Meijili Carpet, Tarkett, Oriental Weavers, Shanhua Carpet, Beaulieu, Shaw Industries, Zhemei CarpetsGrowth Accelerators

As far as woven carpets and rugs are concerned, it is the demand that is fuelled by consumer preference towards aesthetics and interior decoration, mainly stressing comfortable and trendy living. An increase in disposable incomes is also stimulating the use of high-end and decorative floor coverings in emerging economies. The revival of traditional and cultural designs, coupled with increasing interest among the population regarding handcrafted and unique products, contributes significantly to the market. The hospitality and commercial sectors, including hotels and offices, are also driving demand for durable yet rich appearances in woven carpets and rugs. The emergence of e-platforms enables wider access to the world's population for increased sales and market penetration. Sustainability trends are also impacting the market since there is a rising preference for materials that are eco-friendly and ethically sourced. Modern living spaces in developed countries also intensify their need for woven carpets and rugs, which are perceived to be important interior décor items.Woven Carpet and Rug Market Segmentation analysis

The Global Woven Carpet and Rug is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Woven, Tufted, Needle-punched, Knotted . The Application segment categorizes the market based on its usage such as Residential, Commercial. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The woven carpets and rugs market remains hotly contested by international manufacturers and regional ones for the share of that market. Companies like Mohawk Industries, Shaw Industries, and Interface dominate the industry in terms of product diversity, manufacturing technologies, and distribution networks. The design, texture, and sustainable materials are exciting avenues for innovation pursued by companies to keep in step with changing consumer preferences. Equally, partnerships with interior designers, home improvement retailers, and e-commerce platforms are driving greater visibility and possibly entry into the market.Challenges In Woven Carpet and Rug Market

Challenges inhibit the growth of the woven carpet and rugs market, including but not limited to: Fluctuating raw material prices, that is, wool, nylon, and polyester used in making woven carpets or rugs, due to supply chain disruption and price volatility. This rising cost of production directly translates into profit margin squeeze and more expensive sales to consumers, thus reducing consumers' demand from price-sensitive markets. The industry also faces very stringent environmental regulations to minimise production processes that include non-sustainable materials and energy-intensive production processes. Investment to comply with these standards can be quite high, thereby also increasing operational costs to the manufacturers.Risks & Prospects in Woven Carpet and Rug Market

Manufacturing technologies such as digital printing and modular designs provide opportunities for the creation of unique, customizable products that cater to diverse consumer preferences. Furthermore, e-commerce platforms extend the market reach by enabling customers to view and visualise designs online, fostering sales. Investment trends in home renovation and construction activities, especially in residential settings, augment market advances in the respective regions. Regionally, North America leads in the market due to high construction activities coupled with the proclivity for high-end and sustainable flooring options. Europe ranks second, with countries such as Germany, France, and the UK promoting demand through renovation projects, along with a wider focus on artisanal craftsmanship. The fastest growth is predicted in Asia-Pacific, which will be driven by urbanisation and increasing disposable incomes in China and India. Meanwhile, Latin America and the Middle East have different potential opportunities that rest on a rich carpet-making history with an increasing demand for synthetic materials. These regional dynamics outline a variety of growth drivers across the global markets.Key Target Audience

Woven carpets and rug market spectral targets include home dwellers or owners seeking functional flooring aesthetics, including the interior decoration designers, along with commercial property owners. For design, material quality, and price, preferences vary in the residential consumer segment, demanding stylish, durable, and comfortable rugs that complement the home décor. Luxury consumers are more inclined to looking up high-end handcrafted rugs using premium materials such as wool and silk when budget-conscious buyers prefer synthetic alternatives.,, Another major targeted segment is the commercial sector: hospitality, offices, and retail. Woven carpets are valued by hoteliers for their aesthetic value but also resilience, while proprietary office and commercial spaces use the carpets to improve ambiance in addition to noise reduction. Eco-friendly and other sustainable carpets are gaining popularity progressively among environmentalists, thus inciting manufacturers to tread the recycled materials and sustainable production process. Now that e-commerce is fully blossoming, so does carpet-buying savvy in digitally savvy consumers. They will subsequently lead carpet brands to improve their online presence and reputation.Merger and acquisition

The woven carpet and rug market has been witnessing many mergers and acquisitions lately to enhance the market positioning and operational efficiency of players involved. A major event in this regard was the merger of Stark Carpet with Asha Carpets in their efforts to penetrate markets and promote operational synergies. The acquisition of certain assets by Dynasty Carpet from Interfaces has added value to their existing product range and extended their offering of products. There is a trend toward consolidation in this industry, where these mergers and acquisitions allow companies to achieve a wider geographical footprint and enhance their technological capabilities. This fosters the pooling of resources, optimisation of operations, and economies of scale that should position these firms favourably in the international market. >Analyst Comment

The woven carpet and rug market is characterised by a fusion of tradition and industrial manufacture by meeting varying consumer demands. Amidst the growth of the market are also interior design trends where there has been a simultaneous increase in demand for classical and modern designs. Handwoven rugs that have artistic and cultural significance occupy the high-end bracket-scope, while machine-made options are affordable and scalable. Sustainability and ethical production have acquired increasing prominence in the industry, bringing into focus an increasing concern toward the usage of natural fibres and environmentally acceptable dyes.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Woven Carpet and Rug- Snapshot

- 2.2 Woven Carpet and Rug- Segment Snapshot

- 2.3 Woven Carpet and Rug- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Woven Carpet and Rug Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Tufted

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Woven

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Needle-punched

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Knotted

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Woven Carpet and Rug Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Residential

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Dongsheng Carpet Group

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Beaulieu

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Shaw Industries

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Mohawk

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Oriental Weavers

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Milliken

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Atlas Carpet Mills

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Interface

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Dinarsu

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Balta

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Infloor

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Tarkett

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Dixie Group

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Brintons

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Merinos

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Jiangsu Kaili Carpet

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Shanhua Carpet

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Haima Carpet

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 TY Carpet

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 COC Carpet

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 Shenzhen Meijili Carpet

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

- 7.22 HUADE Group

- 7.22.1 Company Overview

- 7.22.2 Key Executives

- 7.22.3 Company snapshot

- 7.22.4 Active Business Divisions

- 7.22.5 Product portfolio

- 7.22.6 Business performance

- 7.22.7 Major Strategic Initiatives and Developments

- 7.23 Zhemei Carpets

- 7.23.1 Company Overview

- 7.23.2 Key Executives

- 7.23.3 Company snapshot

- 7.23.4 Active Business Divisions

- 7.23.5 Product portfolio

- 7.23.6 Business performance

- 7.23.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Woven Carpet and Rug in 2030?

+

-

Which type of Woven Carpet and Rug is widely popular?

+

-

What is the growth rate of Woven Carpet and Rug Market?

+

-

What are the latest trends influencing the Woven Carpet and Rug Market?

+

-

Who are the key players in the Woven Carpet and Rug Market?

+

-

How is the Woven Carpet and Rug } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Woven Carpet and Rug Market Study?

+

-

What geographic breakdown is available in Global Woven Carpet and Rug Market Study?

+

-

Which region holds the second position by market share in the Woven Carpet and Rug market?

+

-

Which region holds the highest growth rate in the Woven Carpet and Rug market?

+

-